Ultrasound technology has continued to evolve in recent years, providing new solutions that enhance imaging techniques, increase workflow, and improve ease of use. Cost-effective and time-saving solutions are becoming increasingly important to end users, and systems that meet these needs are essential to sustain growth in developed healthcare markets.

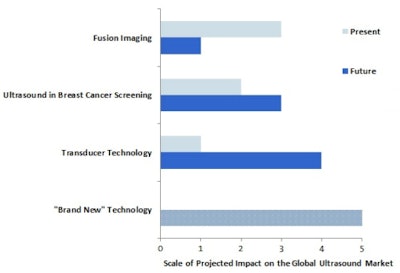

Overall, the position of ultrasound technology remains relatively unchanged, and global market growth is forecast to remain between 5% and 6% from 2013 to 2016, unless a brand-new technology or application is released. InMedica has assessed the most recent advances in ultrasound technology and projected their current and future impact.

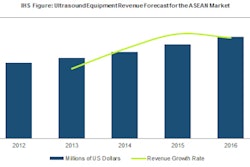

The present state and future projections of the ultrasound market. Source: InMedica.

The present state and future projections of the ultrasound market. Source: InMedica.Fusion imaging

The increasing number of new ultrasound products featuring fusion imaging techniques has created strong interest in this technology over the last couple of years. Fusion imaging allows physicians to superimpose real-time ultrasound images with already taken MRI or CT images, and is increasingly used to provide real-time feedback of needle position during interventional procedures, such as in biopsies.

A number of advances in this technology have helped drive the use of ultrasound, such as new software and visualization packages that allow automatic alignment between the ultrasound and CT or MR image. This is particularly important because in the past the technology was complicated and difficult to use, which often deterred many radiologists from using it.

Further improvements in workflow will continue to drive increased use of this feature, but the initial impact of fusion imaging on the ultrasound market may have already passed.

Transducer technology

The evolution of transducer technology is continuous in the ultrasound market. In recent years, notable progress has been made, including making the shape more ergonomic, moving the position of the beam former, and increasing the number of channels to improve image quality. The Acuson Freestyle ultrasound system from Siemens Healthcare, featuring wireless transducer technology, is a recent introduction designed to improve transducer handling. The maximum impact of wireless technology on the ultrasound market may still be to come; the lack of cables can help reduce infection risk during interventional procedures and improve ease of use, but the rate of data transfer may continue to limit the use of this technology for high-end performance.

Breast cancer screening

Ultrasound is increasingly being used to supplement mammography in detecting tumors that may not be visible with mammography alone. The use of elastography to "type" cancer is increasingly common, assisting in prediagnosis before biopsy. While advances in elastography now allow tumor stiffness to be measured, a lack of harmonization of the measurement scale used, and limited automation, has hindered ultrasound being used as an exclusive screening method.

Automated breast volume sonography (ABVS), released in the last few years, is another option. With ABVS, the field-of-view is larger and the examination provides reproducible and standardized images. The U.S. FDA approval for the somo-v ABUS device from U-Systems, for use in combination with mammography in women with dense breast tissue, may drive increased interest from physicians in the use of ultrasound as a screening tool. Furthermore, the acquisition of U-Systems by GE Healthcare may increase interest among other ultrasound manufacturers, creating greater competition in this market. Despite the strong opportunities, however, it remains a niche specialty. In the future, the level of impact on the global ultrasound market may be dependent on how efficiently manufacturers can scale ABVS and importantly, if widespread reimbursement can be obtained.

All three of these developments have significantly helped to improve the technology available in ultrasound systems, and they are driving demand from both new and existing users. However, can these solutions alone continue to drive strong growth in the global ultrasound market? A new technology or application will be needed to give the ultrasound market a renewed boost. Given that the ultrasound market has progressed significantly during the last 10 years, this new concept could be a long-term development.

Carly Reed is a market analyst in the medical imaging research group at InMedica, a division of IHS (NYSE:IHS). InMedica is a leading provider of market research and consultancy in the medical electronics industry (www.in-medica.com).

Originally published in ECR Today on 7 March 2013.

Copyright © 2013 European Society of Radiology