The medical imaging services market in Europe is a challenging one in which vendors will need to expand their service portfolios to include customized offerings, according to market research firm Frost & Sullivan.

Its newly published report, titled "Service Opportunities for Medical Imaging Market of Europe," states the market to provide mobile imaging services, maintenance services, and managed equipment services is highly fragmented, best with pricing pressures, and intensely competitive.

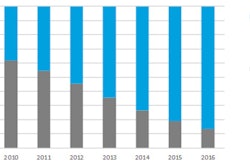

The medical imaging services market in Europe earned revenues of 5.05 billion euros ($6.13 billion U.S.) in 2010 and is estimated to reach 8.1 billion euros ($10.1 billion) in 2017.

An increase in the range of services offered by vendors has reduced the costs incurred on the maintenance of hospital equipment for larger hospitals, according to research analyst Kaavya Karunanithi. These services include fixed contracts by third-party providers, asset management and financial planning, managed services, and training and upgrades.

Expanded service portfolios offering competitive, customized solutions catering to the demands of all user groups have benefited from market growth. Services now offered include all aspects related to medical equipment, such as procurement, installation, maintenance, user training, insurance, upgrades, financial planning, performance monitoring, and asset management. The resultant reduction in equipment downtime and distribution of capital asset investment over a period of time has enabled capital savings of 15% to 20%.

Karunanithi recommended that service providers understand local market dynamics and provide service products that are value-based and meet the needs of a variety of customers. Providing rapid response times and minimum downtime, as well as offering low-cost upgrades, are needed for competitive success.