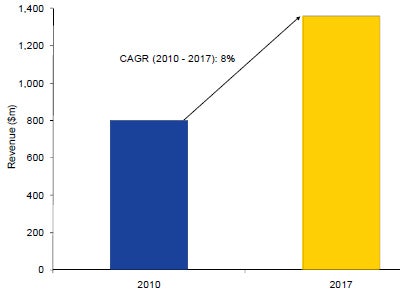

The global market for full-field digital mammography (FFDM) is expected to exceed 1 billion euros ($1.3 billion U.S.) in the next five years, market research firm GlobalData is predicting. The 8% compound annual growth rate will be driven primarily by increased preference for FFDM systems over analog units, increases in reimbursement, and the U.S. Food and Drug Administration (FDA) reclassification of the devices.

In 2010, the FFDM market was valued at 618 million euros ($801 million). In addition to replacing film-screen mammography systems, another market driver will be the incorporation of modalities such as ultrasound and MRI with mammography for improved cancer detection.

Full-field digital mammography equipment market, global, revenue ($m),

2010 - 2017

The U.S. is the largest FFDM market, contributing 51% of the global revenues in 2010. The U.S. market was valued at $407 million (318 million euros) and is expected to reach $713 million (557 million euros) in 2017, according to GlobalData.

The primary reason for growth in the U.S. is the FDA's reclassification of FFDM from class III to class II, which makes it easier for companies to get clearance for new devices. As a result, FFDM products no longer need to go through the premarket approval (PMA) process to prove their safety and efficacy; instead, they'll go through the less rigorous 510(k) process.

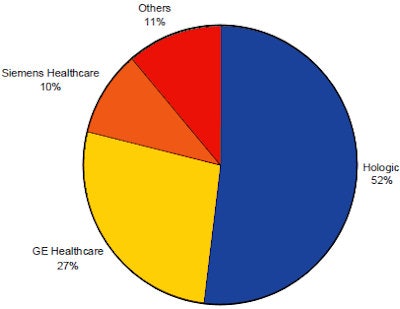

"The reclassification will also enable new companies to enter the market, which will increase competition," the authors noted. "FDA approvals for FFDM systems from Hologic, GE Healthcare, and Siemens Healthcare in 2011 are expected to further intensify the competition."

Hologic dominated the FFDM global market in 2010 with a share of 52%, followed by GE Healthcare (27%), and Siemens Healthcare (10%). Hologic had a higher presence in the U.S. with a 70% market share; while in Asia-Pacific, GE was more dominant; and in Europe, Siemens was the market leader. Philips Healthcare should see an increase in its market share after acquiring Sectra's mammography unit in 2011.

Full-field digital mammography equipment market, global,

company share (%), 2010

GlobalData also predicts that the increasing demand for preowned medical equipment will negatively affect sales of new FFDM equipment. "The refurbished equipment market is no longer a place of uncertainty but provides relatively new equipment at a significant discount," the company said. "Refurbished mammography equipment is available at a discount of 30% to 50% in developed economies such as the U.S. and Europe. This encourages hospitals to purchase refurbished equipment,and provides them the opportunity to use a combination of modalities such as ultrasound and MRI with FFDM for breast imaging at low cost."