More than 80% of imaging facilities in Europe have experienced a major decline in the volume for procedures not related to COVID-19, according to a new survey from market research firm IMV Medical Information Division.

Even after factoring in COVID-19 imaging, the respondents said imaging volume dropped for all surveyed modalities except for mobile general x-ray units, which instead experienced a 51% increase in procedure volume. However, other popular modalities for COVID-19 imaging, such as CT scanners and ultrasound units, weren't spared from sometimes drastic decreases in volume.

The findings demonstrate that medical imaging facilities have been hit hard by the pandemic. The state of affairs likely won't return to normal until health professionals have more resources to combat the novel coronavirus, according to Craig Overpeck, CEO of Science and Medicine Group, the company that houses both IMV and AuntMinnieEurope.com.

"We expect this pandemic paralysis to continue at different levels in different states and countries and will not fully resolve until we have solutions in the toolbox for the detection, treatment, and prevention of COVID-19," Overpeck said during a 29 April webinar discussing the survey.

Procedure volumes fall

The data come from an IMV survey of more than 600 imaging facilities in the U.S. and Europe, with respondents spread throughout most U.S. states and many European countries.

A total of 82% of the respondents in Europe said they've experienced a major decline in noncoronavirus procedure volume due to the pandemic, and only 6% of facilities have experienced no decline at this time.

"Almost no place has been spared, and as an industry, we are experiencing a very high level of disruption," Overpeck said.

Survey respondents reported that mobile general x-ray units were the only modality with an increase in procedure volume in Europe. Modalities used for COVID-19 imaging tended to be among the least affected, including mobile x-ray and CT, while x-ray mammography units were the most affected.

| Impact on procedure volume due to novel coronavirus in Europe | |

| Imaging modality | Procedure volume |

| Mobile general x-ray units | +50.7% |

| Portable C-arm units | -26.4% |

| CT scanners | -28.6% |

| Fixed general x-ray radiography units | -28.9% |

| Fixed C-arm systems | -31.1% |

| Fixed PET and/or PET/CT | -32.8% |

| Fixed nuclear medicine camera | -35.3% |

| Ultrasound units | -40.2% |

| Fixed radiographic fluoroscopy systems | -43.5% |

| Fixed MRI scanners | -44.9% |

| X-ray mammography units | -61.6% |

Almost two-thirds of respondents in Europe said that COVID-19 is having a significant impact on their department, rating their department disruption as 9 or 10 on a 10-point scale. Another 25% reported the impact has been neutral, with a rating of 7 or 8, and 9% said the impact was minimal, with a rating of 6 or lower.

Staffing crunch

The changes in procedure volumes have directly affected staffing and budgets, according to Lorna Young, senior director of insights at IMV.

"The significant drop in multiple modalities that we have just seen directly impacts their operations, including staffing, operating hours, and their budgets," Young said during the webinar.

Nearly half of all respondents reported the decrease in volume contributed to staff layoffs or furloughs, and 43% said it was related to a reduction in operating hours. In Europe, half of the respondents said attending conferences is one of the most affected areas in their department during the pandemic.

As for the future, survey respondents said they anticipate pandemic will decrease the average amount of money their department spends on all imaging products except for mobile general x-ray units.

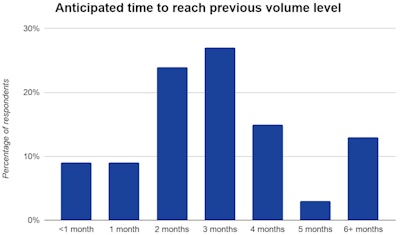

They're also split on how long they think it'll take for volume to ramp back up. More than half of respondents think imaging volumes will return to normal in 2-3 months, but Overpeck believes it'll likely depend on where you live.

"How long will all of this last? Well, the answer depends on where you live and when your area will reopen," he said. "Consumer demand will also be a driving factor in addition to a facility's ability to ramp up."