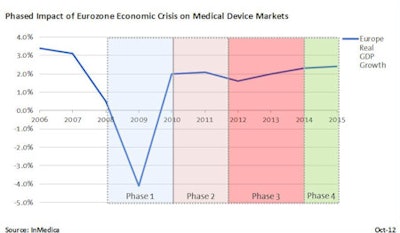

The European economic outlook may be showing the first signs of positivity after three years of gloom, but the outlook for medical device markets remains bleak. In fact, 2012-2014 is predicted to be the most challenging period for device suppliers since the Eurozone spiraled into recession in early 2009.

Until the economic collapse, business had been strong for medical device suppliers in Europe. Healthcare spending continued to broadly rise across the European regions from 2005 to 2008 -- a response to an aging population, a proliferation of chronic disease states, and European Union (EU) subsidized healthcare funding for new member states in Eastern and Southern Europe. Advances in device technology further spurred demand for top-end devices, particularly in advanced medical imaging and healthcare IT infrastructure programs.

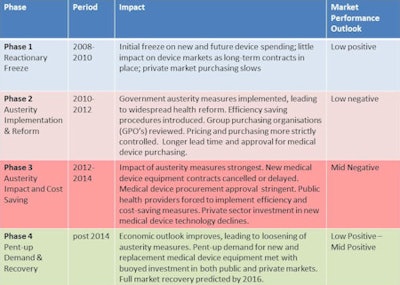

However, the economic crisis quickly exposed that rises in healthcare costs were unsustainable, prompting action from both public and private healthcare providers. Based on rigorous primary research with medical device suppliers, we have provided an overview of past, current, and future economic impact on medical device markets in Europe.

Phase 1: The reactionary freeze (2009-2010)

The initial economic crisis had moderate impact for medical device suppliers. While some public and private providers froze funding plans for future purchasing of medical equipment, the majority of medical device markets performed robustly. Revenue growth remained positive for the vast majority of device markets, albeit down from the "boom" period of 2005 to 2008. Existing equipment procurement contracts also were unaffected, leaving long-term equipment purchasing and lease deals in place. Private sector medical purchasing was observed to be slow, a consequence of tightened credit from lenders.

Regionally, the Western Europe cluster of mature healthcare markets fared well, buoyed by large, long-term group purchasing organization (GPO) contracts and preplanned public funding. In contrast, the more volatile and risky emerging markets of Eastern Europe were hit harder, as lending ceased and private investment dwindled. Initially, there were some extreme cases of market impact, mostly in low-volume, high-cost medical device markets. For example, sales of advanced imaging (MRI, CT, and interventional x-ray) fell by more than 10% in many mature markets, while large-scale healthcare IT projects also suffered in pockets, declining by as much as 50% in Italy, Spain, and Portugal.

Source: InMedica

Source: InMedicaPhase 2: Austerity implementation and reform (2010-2012)

Despite pockets of the European market being immediately impacted, the medical device outlook in late 2010 still remained relatively positive. Annual sales in 2010 in many device markets had shown some bounce-back and growth on 2009, prompting cautious optimism for 2011 and beyond. However, as the economic situation worsened again in early 2011, in response to the Greek debt crisis and subsequent bailouts, medical device markets were more heavily impacted.

Government austerity initiatives were widely implemented in 2011 and 2012 in response to the worsening economic outlook. Examples such as Austria's 1.7 billion euro ($2.2 billion U.S.) healthcare budget cut, Italy's 5% blanket reduction on all medical device reimbursement, and France's significant health insurance deficit quashed growth across the Western European medical device markets. Furthermore, widespread healthcare reform was discussed, debated, and implemented, further complicating and slowing procurement of medical devices. Few device markets experienced significant growth in 2011, with many suppliers hoping to sustain market revenues in 2012 "at best."

More important, the healthcare reform and austerity measures implemented during this period will have wide-ranging consequences for the short-term and midterm future of the European market.

Phase 3: Austerity impact and cost saving (2012-2014)

While current economic forecasts suggest recovery should continue in Europe throughout this period, for medical device suppliers the outlook could be far worse. We predict that austerity measures and healthcare reform will have the most impact on healthcare procurement in 2013 and 2014. In Western Europe, a market dominated by long-term contracting, new business, and tenders will be few and far between. Moreover, many existing or renewal contracts have been reviewed, downsized, negotiated, or cancelled as part of government measures to curb spending.

Reimbursement costs also have been widely reviewed and reduced for core services, increasing competition among health insurers, hospital groups, and providers while driving down equipment pricing across the European region. Continued economic strife in Greece, Spain, Portugal, and Italy will further add unease to lenders and creditors and reduce the ability of the private sector to invest in new devices. Across medical device markets, forecast market development looks weak. Growth in recently strong markets, such as compact ultrasound imaging equipment, is predicted to be subdued, while investment in new medical technology and devices such as telehealth will be delayed or shelved until funding is more widely available.

Phase 4: Pent-up demand and recovery (post-2014)

In the midterm, we predict a gradual yet solid recovery for the medical device markets of Europe from 2015. With economic stability, austerity measures will be loosened and investment in updating and improving healthcare public services will drive spending. In addition, pent-up demand for replacement of equipment deemed "nonessential" during phases two and three will drive stronger equipment purchasing. Lending restrictions also will ease, allowing greater opportunity for private healthcare investment in medical equipment.

However, a return to prerecession spending levels and healthcare procurement structure is unlikely. Instead, approval for equipment purchasing will be more heavily based on cost-efficiency and long-term investment benefits, as well as the improvements in care provided by using such devices. Furthermore, investment in new and advanced medical device technology will return to mature markets. We also predict significant investment in new technology and infrastructure projects will restart from 2015. This will be most notable in markets such as telehealth, clinical information systems (CIS), and electronic health records (EHR).

Every cloud ...

Despite the relatively bleak outlook for medical device markets in Europe, pockets of opportunity remain. Russia, for example, is already in progress with a five-year plan to update and improve nationwide public healthcare services, and in the U.K. the largest telehealth trial to date is on the cusp of starting. More important, the economic downturn has changed the attitude of the medical device market.

Cost-efficiency and "lifetime" equipment cost were rarely considered prerecession for many capital medical device purchases, despite the spiraling costs of healthcare. Now, in the new age of austerity, more responsible healthcare spending is being advocated and enforced. While this may impact the bottom line and profit sheet for many medical device suppliers, it should also ensure the long-term future of medical device markets in Europe. The challenge for suppliers is to develop medical device products that are innovative in their features and technology and also affordable, efficient, and accessible.

Stephen Holloway is a senior analyst at InMedica (www.in-medica.com), a division of IMS Research (recently acquired by IHS (NYSE: IHS). InMedica provides research and analysis on key medical markets, including Medical Imaging, Healthcare IT, Clinical Care, Consumer Medical Devices and Digital Health.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.