This year was one of mixed results for the medical electronics industry. The economic uncertainty and austerity measures implemented by many governments in Europe continued to dominate the headlines. In Europe, the long-term impact of the economic crisis is forecast to provide the most challenging period for medical device suppliers in 2013, in the last 15 years. We expect a continued mix of challenges and opportunities, and the following predictions for 2013 serve to provide some guidance as to where these will come from.

Despite encouragingly robust market performance from 2010 to 2012, the long-term impact of the global economic crisis is forecast to provide the most challenging period for medical device suppliers in 2013. Renegotiation of group purchasing contracts, cuts in reimbursement, and a volatile credit market will hinder both public and private investment in new devices. Furthermore, investment in new technology will be subdued with healthcare providers unwilling to invest without extensive evidence of guaranteed clinical and financial benefits.

Top 3 trends for 2013

1. Wireless to become more integral to x-ray technology

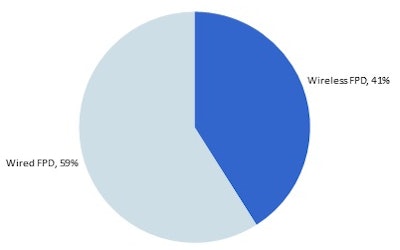

Since 2009, the global general radiography x-ray equipment market experienced a shift toward wireless flat-panel display (FPD) technology. In particular, wireless FPD technology in mobile x-ray is driving growth. The ability to place panels directly under or around critically ill patients at the bedside without having to move them provides significant workflow gains and improves care.

Wireless FPD panels are also providing cost-saving solutions for healthcare providers with fixed rooms, allowing panels to be shared across different radiography rooms and systems. For example, rooms can use one wireless panel for different applications from the bucky table to the wall mount.

X-ray is also forecast to become more modular. Wireless retrofit upgrade systems and purchasing additional panels allows hospitals to purchase x-ray equipment solutions to fit their individual needs, rather than installing full new general radiography rooms.

Wireless is not only going to be seen in panel technology, but will also become integral in other parts of the system, with some new systems including wireless foot switches to control bucky table movement. This will improve hygiene with fewer cables, less risk of tripping and more maneuverability. Wireless is also emerging in other medical imaging modalities, with some ultrasound systems introducing wireless transducer technology at RSNA 2012.

We predict that wireless FPD general radiography x-ray equipment will account for more than 41% of unit shipments in EMEA 2013.

EMEA wireless FPD versus wired

Source: InMedica

Source: InMedica2. Increased adoption of PACS & vendor neutral archiving (VNA) managed services takes images to the cloud

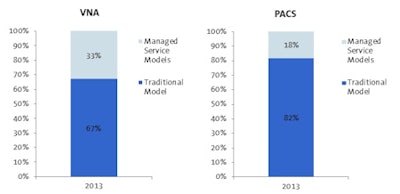

With decreasing healthcare budgets and hospitals under increasing pressure to reduce storage costs and enhance access to data and improve productivity, managed services (a model where a vendor owns the IT infrastructure and is responsible for managing and hosting the software and data center) are increasingly in demand. These models are being adopted as a method of increasing the level of vendor services, whilst reducing storage and application costs.

Hybrid and hosted managed service models can offer significant reductions in storage and maintenance costs to healthcare providers; users only pay for storage used and the vendor is responsible for the majority of service provisioning. However, these models are restricted by concerns over performance and security, as well as by poor bandwidth to transmit data to off-site locations in less developed geographies. Concerns over performance include the ability of the application to provide continuous uptime and instant access to data that is located off-site, without compromising image quality.

There are however, regional variations in demand, with France, the U.K., the Nordics, Belgium, and the Netherlands more open vendor-hosted models, while Italy, Germany, Austria, and Switzerland enforce stricter data security regimes.

We forecast that revenues from managed service models will grow to around 18% of the total PACS revenues in 2013 in Western Europe, with almost a quarter of those involving a model where the vendor hosts images in an off-site data center.

Even higher adoption is projected in the VNA market, with managed service models projected to grow to 33% of Western European revenues in 2013. The majority of these revenues will be from hybrid cloud models where the primary copy of an image is stored on-site, but the secondary copy is remotely hosted. Full cloud models, however remain restricted.

Managed service models in the PACS and VNA market - 2013

% revenues

Source: InMedica "Managed service models versus traditional models in the PACS and VNA Market -- Western Europe - 2013."

Source: InMedica "Managed service models versus traditional models in the PACS and VNA Market -- Western Europe - 2013."3. Best-of-breed wins against electronic medical records in the clinical information systems market in Europe -- but loses in the U.S.

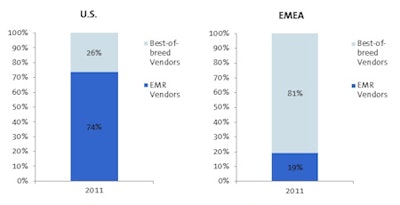

Competition is increasing in the clinical information systems (CIS) market between the best-of-breed vendors and electronic medical record (EMR) vendors. Whilst best-of-breed solutions are tailored to meet the demands and functionality needed for a specific clinical department, EMR vendors aim to provide an enterprise-wide solution.

In the U.S., EMR stimulus payments for hospitals that meet "meaningful use" requirements are driving more hospitals to move to enterprise-wide solutions. This gives EMR vendors an advantage in the CIS market as their systems can be expanded to cover all clinical departments. Increasingly, a number of EMR vendors are developing and incorporating clinical modules for critical care, anesthesia, and neonatal care in their solutions.

However, in Europe, the trend remains for best-of-breed systems with less impact of EMR suppliers as compared with the U.S. Best-of-breed suppliers are seen to better meet the workflow requirements of specific clinical departments. This coupled with a low penetration of EMRs in Europe means best-of-breed vendors will continue to dominate the CIS market in Europe in 2013.

In the longer term, as EMR penetration increases in Europe, European best-of-breed CIS vendors will need to protect the CIS market from EMR vendors by strengthening their solutions to become integral to clinical departments, strongly educating customers on the benefits of best-in-breed over enterprise, and matching the reduced prices EMR vendors can offer.

Best-of-breed vendor versus EMR vendor in critical care information

systems market

Revenues $ millions

Source: InMedica "The world market on electronic medical records and clinical information systems - 2012."

Source: InMedica "The world market on electronic medical records and clinical information systems - 2012."The authors are market analysts in the medical imaging and healthcare IT research groups at InMedica, a division of IHS (NYSE:IHS). InMedica is a leading provider of market research and consultancy in the medical electronics industry (www.in-medica.com).

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.