The Healthcare Information and Management Systems Society (HIMSS) & Health 2.0 European Conference attracted over 2,600 delegates from 64 countries to Helsinki in June 2019. While there was a strong focus on healthcare in the Nordics, the conference brought with it a wide variety of vendors from across the globe all looking for new opportunities on the show floor.

Our key takeaway is the goal to change mindsets in Europe toward how healthcare can be improved through the use of technology. This article looks at developing integrated care networks through regional procurement, better localization of electronic medical records (EMRs), and the use of telehealth.

Regionalization's becoming the norm

The push toward implementing new innovative healthcare models is gaining momentum across Europe, with a few examples showcased on the agenda at HIMSS. Vendors looking to operate in this market increasingly are having to work with complex regional health systems and interoperability frameworks.

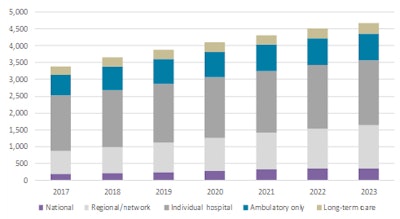

The chart below shows projections for the electronic health records (EHRs) market in Europe, Middle East, and Africa (EMEA), with splits for type of solutions purchased. It shows regional/network EHR spending is forecast to grow at the highest rate over the next four years, starting to rival the market for EHRs purchased by individual hospitals by 2023.

Source: Signify Research.

Source: Signify Research.At HIMSS Europe, the Estonian government showcased developments in the country's national EHR project. All of Estonia's health data are effectively digitized, including prescriptions and billing, while also incorporating blockchain technology and using local digital vendors. The next step for Estonia is to move toward preventive services for breast cancer and cardiovascular diseases, with a goal to create individual health plans for citizens by 2023.

The Dutch government also came out in force at HIMSS. Nictiz, the Ministry of Health independent interoperability group, outlined its plans to deliver information exchange. Its core goals are to standardize medication data by 2019, create a patient-accessible EHR by 2020, establish a unified national data exchange network, and deliver longitudinal records at the point of care.

In Helsinki, a lot of the discussion was around scaling these solutions at regional and national levels but also including major stakeholders from providers and vendors to get organizations onboard early. This could open up opportunities to work more closely with these larger regional organizations for Dutch vendors, such as ChipSoft, Cerner, Nexus, and Epic.

The need for localization

Historically, international EMR vendors have had two major points of entry to penetrate into a new geography: either through a partnership to gain expertise and "localize" a solution or through the acquisition of a local vendor. Both have their challenges, with acquisition often resulting in the long-term support of a legacy solution (e.g., Cerner is still supporting several legacy Siemens EMR solutions nearly five years after announcing its acquisition plans) and partnerships often being slow. Examples where vendors have taken on large regional projects before "localizing" solutions have often resulted in projects running over budget and negatively affecting both vendors and providers alike.

One company with growing stakes in the Nordic markets is Epic, and HIMSS Europe provided a chance to hear some key learnings from its three major EpicCare implementations at different stages across the region. Each is sold under the idea that a large regional project needs a scalable solution that can deliver interoperability and future functionality around integrated care or population health management. Finland is implementing its integrated social care record (including Epic's HealthyPlanet) across four municipalities, although this has already been hampered by some delays.

During the Accenture Workshop, we got a chance to hear from both the upcoming Epic deployment in the Norway Central Region and the learnings from the Capital Region deployment in Denmark from the implementation teams at the heart of the projects. In both cases, the governments went against contracting with the local vendor (Systematic in Denmark and DIPS in Norway) and looked toward regional teams to implement the Epic solution.

Issues around the Danish implementation were exacerbated as it was Epic's first deployment in the country. This complicated medical translations, adding to the idea some form of localization prior to winning a large regional project would have eased some of these issues. A key discussion point around the deployment in Denmark was the resistance put up by EHR users on the go-live date. A lack of engagement with clinicians to understand the nuances of their existing workflows resulted in backlash when the new system required additional input on their end.

This is something that arguably should have been core to the project plan from the start for both providers and vendors. The Norwegian Central Region should look to engage key stakeholders in its upcoming deployment, as well as outlining how to measure success post its rollout.

This pivots into what was the key takeaway from HIMSS Europe. There are far too many examples on the global market of vendors overpromising what they can deliver without fully understanding all the nuances in a country's healthcare ecosystem. While many solutions are procured at a hospital or regional level, the ones using solutions are the clinicians and physicians, and they will ultimately have a major influence in whether a deployment has been successful or not.

This group's importance is seemingly underestimated, and engaging this group at an early stage can be invaluable to ensuring that health IT is being used effectively and delivers on its initial goals. The onus of a delayed or overbudget delivery will fall on a vendor's shoulders and poor implementation can have ramifications for the future rollout of health IT in a given country.

Scaling virtual care

From on-demand video consultations to the deployment of telestroke networks and the plethora of remote patient monitoring programs underway, it seems that Europe is finally starting to catch up with the U.S. in terms of telehealth and, at last, is moving beyond the pilot/trial status that has defined the market for many years. This move from pilot to scaled deployment was evident on the show floor at HIMSS Europe.

In primary care, consumer on-demand video consultations are now widely deployed in the U.S., with companies such as American Well, Teladoc, MDLive, and Doctor on Demand, providing several million low-acuity consultations on behalf of commercial payors and employers every year. The structure of many European primary care markets, with local independent general practitioner (GP) practices providing government-funded primary care, has meant market entry for commercial telehealth service providers has been complicated. The incentives for local providers to develop telehealth services of their own have been lacking. However, this is starting to change, and in Helsinki several local virtual care platform and service providers showed numerous cases of local successes setting the scene for scaling their success across the continent.

LIVI -- or KRY as it is known in Sweden -- was demonstrating its virtual care services on the floor in Helsinki. The company initially had success in the telehealth market providing low-acuity video consultation services in Region Jönköping County in Sweden. It started offering these services in 2015 and had provided more than 700,000 virtual consultations by the end of the first quarter of 2019.

At HIMSS Europe, the vendor was pushing its geographic expansion credentials, specifically those in France and the U.K. with plans to move into Germany later this year. It tackles geographic expansion by partnering with local providers or setting up its own local primary care networks and using its virtual care platform to direct patients to its clinics. It is estimated to have raised over 79 million euros through series A and B funding, with its major customers being families on a pay-per-consultation basis.

In the U.K., it is already active across Northampton and North West Surrey GP practices. However, its forays into France suffered a setback, with government reimbursement decisions not going its way, potentially limiting the company's medium-term success in France. This is not just an issue in France, and as telehealth service providers expand their geographic footprint, ensuring they can navigate local reimbursement structures will be a key to success.

VideoVisit was another Nordic telehealth solution provider showcasing its offerings at the HIMSS meeting. VideoVisit is slightly different to KRY in that it is a platform provider and not involved in directly providing healthcare services -- it provides the tools to allow brick-and-mortar primary care physicians to roll out their own telehealth services. Where it does have similarities is it is also looking to provide a solution for patient-to-provider home video consultations. However, it has started to address other parts of the telehealth market, such as provider-to-provider consultations and supporting higher-acuity patients with chronic conditions. It was in this area that it was pushing its new products at HIMSS Europe, namely VideoVisit Remote. VideoVisit Remote is the product of a joint venture with Taiwan-based Medimaging Integrated Solution (MiiS) and is focused on supporting remote diagnostics.

VideoVisit is Finland's largest telehealth vendor, mostly known for selling its outreach solutions sold directly to the Finish municipalities. With little local competition, its goals are to expand its telehealth offerings in Finland and scale its services internationally, with it securing 1.5 million euros of funding in May 2019.

These are just two examples of video consultation platform/service providers that started out having success in one European area and are now looking to expand into others. However, there are many more examples across Europe, and the market continues to be highly fragmented in terms of supply.

Consolidation of the supplier base is forecast to be a key theme over the coming years, and increasingly some of the U.S. service provider/platform vendors mentioned earlier are expected to be seen in European markets. Teladoc and American Well have both made acquisitions over recent years that will give them a primary care footprint in Europe (particularly Teladoc), so as these country-specific virtual care providers expand across the continent, expect the large U.S. providers to also be looking to stake a claim in the growing European market. Time will tell if American Well and Teladoc are on the exhibition floor at HIMSS Europe 2020. But I wouldn't bet against it.

Inpatient care

The above focused on the use of telehealth in nonemergent settings. However, demand for technology to support telehealth in acute and inpatient settings also is growing in EMEA. The EMEA market for telehealth platforms, hardware, and services in acute settings is forecast to be worth more than $500 million in 2022, according to Signify Research's 2018 telehealth report. However, this is still much smaller than the equivalent North American market forecast (over $900 million). That said, several vendors that have generated significant revenues in the U.S. acute market, were at HIMSS Europe in an effort to tap into broader international markets.

Philips was one, demonstrating its Tele-ICU technology with its major strategy in Europe aimed at working with central hospitals with larger intensive care units (ICUs). The overwhelming majority of Philips' Tele-ICU business is driven by the U.S.; however, it has also had success in selling its solution in the United Arab Emirates, India, the U.K., and Japan. It's one of the few vendors in the marketplace to offer a centralized solution. However, this does present some challenges in relation to the cost of the technology and cost of process reengineering when being implemented. For this reason, the number of Philips Tele-ICU customers in Europe has remained relatively low to date. However, Philips has proved the business model well in the U.S. market, where approaching 20% of all ICU beds are monitored using Tele-ICU technology. As hospitals in Europe are increasingly digitized, the market for Tele-ICU solutions is forecast to start to ramp up, and Philips is positioning itself well to take advantage of this.

GlobalMed is an inpatient telehealth solution vendor that is being largely driven by U.S. inpatient business, but it was at HIMSS Europe to grow its international business. The company already does have good credentials with success in the U.K., Spain and Portugal, Slovenia, and the Middle East and Africa, providing solutions for inpatient surgical and medical support. Its recent announcement to implement its virtual care platform on Microsoft Azure, restructure some of its cart-and-platform packages to software-as-a-service (SaaS)-type models, and beef up its team will certainly support its continued international expansion.

Michael Liberty of Signify Research.

Michael Liberty of Signify Research.While the primary care telehealth market is defined by vendor and service provider fragmentation, the acute and inpatient markets are markedly more consolidated, with vendors such as the two above, along with U.S.-based InTouch Health, Avizia (now owned by American Well) and AMD Global dominating the market. None of these others were at HIMSS Europe this time, but, like above, their presence in 2020 would not be a surprise.

Michael Liberty is a senior market analyst at Signify Research, a health tech, market-intelligence firm based in Cranfield, U.K. He specializes in digital health.