Agfa-Gevaert Group, parent company of Agfa HealthCare, announced on 2 December that it had entered exclusive negotiations with Dedalus Holding to sell part of its healthcare IT business -- specifically the business tied to its electronic medical record (EMR) and integrated care offerings. Now's a good time to look at the implications.

The facts are listed below:

- In May 2019, Agfa stated it would explore selling its hospital IT and integrated care (HCIS) solutions business.

- This process was brought a step forward toward conclusion on Monday with the announcement that the deal, valued at 945 million euros, would be completed during the second quarter 2020 and that negotiations would be on an exclusive basis with Dedalus.

- The HCIS business comprises its EMR and population health management/integrated care portfolio.

- Some imaging business may be sold with the HCIS business in cases in which the customer relationship is tightly integrated with the HCIS business, although most of its imaging business will not be sold.

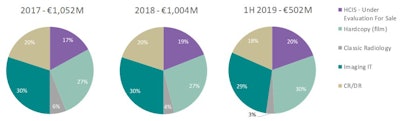

- Its HCIS business had revenues of approximately 191 million euros in 2018, or 19% of Agfa HealthCare's 2018 business.

Agfa's HCIS business, driven by its Orbis EMR system, is an attractive acquisition, given its recent performance in terms of revenue growth. The HCIS business outperformed the rest of Agfa HealthCare over the last 24 months, with high single-digit growth in 2017 and 2018. Whereas Agfa HealthCare as a whole saw revenues decline by 3.5% and 4.6% in 2017 and 2018, respectively, with all other subbusiness lines -- classic radiology, imaging IT, computed radiography/digital radiography (CR/DR), and hardcopy film -- all showing declines/flat performance over the same period.

Source: Agfa HealthCare Investor Relations.

Source: Agfa HealthCare Investor Relations.That said, the company's HCIS customer footprint is focused on just a few regions and is less geographically diverse than its other business lines.

Orbis is used in more than 1,300 healthcare facilities in Germany, Austria, Switzerland, and France (DACH), as well as Brazil and Belgium, with the majority of customers in DACH and France. In these two markets, Agfa holds a commanding position in terms of revenue share, particularly in the acute market. It held the No. 1 position in terms of revenue share in the DACH acute market in 2018 and No. 2 spot in France, second only to Maincare Solutions. It is also a key player in Belgium and Brazil, although further down the rankings in both geographies.

Dedalus' EMR and integrated care business

Signify Research estimates that Dedalus' EMR business was worth approximately 160 million euros in 2018, so it would be the slightly smaller player in the combined company. As well as addressing the acute market, it also has some solutions that address the primary care market (e.g., in Italy), an area that Agfa has not focused on historically.

Dedalus has a broader international footprint compared with Agfa, and there are several countries where there is overlap, particularly in France through Dedalus' 2016 acquisition of Medasys/NoemaLife. Should the Agfa acquisition go ahead, the combined entity would become the market leader in France.

Outside of France, Dedalus is also strong in Italy (estimated to be No. 2 in the market in 2018) and Spain, with a smaller footprint in Benelux, Eastern Europe (e.g., Romania) and the U.K. Like Agfa, the company is also a player in the Latin American market. Its share is relatively small there, but it is selling into countries that Agfa does not yet serve. Several years ago, it also expanded into in Africa (e.g., South Africa), the Middle East, and Asia (e.g., China), particularly via its solutions that address interoperability.

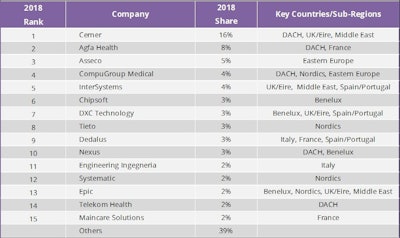

The new combined entity would become a leading international EMR vendor, second only to Cerner in terms of the Europe, the Middle East, and Africa (EMEA) acute market share (as shown below).

Source: Signify Research.

Source: Signify Research.Demand for integrated care technology

A key trend across many European EMR markets over the coming years will be the increasing importance of supporting integrated care technology. Several initiatives are underway across EMEA (and beyond) that will increase the demand for IT that allows different organizations across the healthcare continuum in a region/country to work together to provide holistic care for patients. Examples include the following:

- Strategic transformation partnerships/integrated care systems in the U.K.

- The Integrated Care for a Better Health Plan in Belgium

- Territoire de Soins Numérique (TSN) pilots in France, and to some extent the development of territorial hospital groups

- The rollout of Fascicolo Sanitario Elettronico (FSE) in Italy

- The Coordination Reform in Norway

Agfa moved to take advantage of this trend with its acquisition of French integrated care vendor Inovelan in April 2018, allowing it to supplement its Integrated Care Engage Suite of solutions. These solutions sit in the HCIS business that will be purchased by Dedalus should the deal go ahead. Dedalus itself also is strong in this market.

Looking to the future

The clearest challenge going forward for the combined company will be supporting the multitude of EMR and related products that its customers use. Dedalus already markets and supports a broad range of different products in different countries and this will be added to as it brings Orbis and the Engage Suite into its offering.

With the Agfa acquisition, the combined portfolio may start to look a little bloated in terms of product range and functionality overlap.

The local nature of EMR markets demand that IT developments are highly tailored to the local market's operations and workflows and pushing one-size-fits-all solutions across a broad geographic footprint can backfire, as some of the U.S. vendors have experienced with their European endeavors.

Over time it would make sense for a strategy to be developed that streamlines the breadth of portfolio that the combined entity would offer to bring greater operational and support efficiency; however, moving too fast with this strategy could alienate its customer base, particularly if forced to migrate to platforms that are not as well suited to a country's healthcare workflows. Straddling the fine line between a streamlined portfolio and maintaining customer satisfaction will be the company's toughest challenge over the short to medium term.

Another key element of the EMR market is the demand for well-resourced local implementation, project management, system integration, and support teams. EMR vendors need to complement their IT offerings with the ability to closely support every upgrade, new implementation, product addition, and more that their customers demand. It is partly for this reason that there are few truly global EMR vendors. The combined entity will have one of the broadest international footprints of any EMR vendor, with only a few others such as Cerner and InterSystems having similar ones. Ensuring that it has the resource and local relationships to support this will be key to long-term success.

Alex Green of Signify Research.

Alex Green of Signify Research.Despite these challenges, should the deal go ahead the combined company is well positioned to succeed, particularly in Europe. Integrated care will be the engine of growth in the European EMR market over the next five years. The large installed base of customers held by Agfa and Dedalus, combined with a strong integrated care portfolio, means that there is great potential for Dedalus to take advantage of this trend and grow business with its existing customer base. The scale of the new company will also mean it is better resourced to continue expansion and chase new business in both the countries it already serves and new regions.

Alex Green leads the section on integrated care IT, EHR/EMR, and telehealth at Signify Research, a health tech, market-intelligence firm based in Cranfield, U.K.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.