Demand for diagnostic imaging is increasing each year. The volume of examinations in the U.K. and Ireland reached 50.7 million in 2018 -- a rise of 1.7% versus 2017 -- of which x-ray accounted for over half of overall demand by modality. The rise in imaging examinations has been driven by several factors, including increased accident and emergency admissions, a move toward National Health Service (NHS) seven-day working, and the higher demand for CT and MRI.

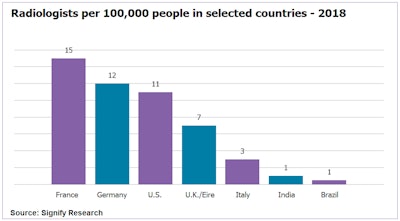

The U.K. and Ireland's imaging market has suffered from the similar growing pressures on healthcare resources across many countries globally. Also, there is an extreme shortage of radiologists; in 2018, there were an estimated seven radiologists per 100,000 people in the U.K. and Ireland, which is particularly low compared to the European average (13 radiologists per 100,000 people) and the U.S. (11 per 100,000). Additionally, the U.K. and Ireland had the lowest diagnostic imaging scans-to-population ratio in 2018 (71.5%). In comparison, the ratios in France (122.1%) and Germany/Austria/Switzerland (144.1%) were substantially higher.

These shortages are fundamentally due to the NHS lacking the in-house capacity to read the rising quantity of diagnostic images; only 2% of the U.K.'s NHS trusts (or hospital groups) were able to meet their reporting requirements within their radiologists' contracted hours in 2018, down from 8% in 2014.

There is also a shortage of radiologists capable of interpreting more specialist and complicated scans. Between 2014 and 2018, there was a 54% increase in demand for CT and a 48% increase in MRI exams, but workforce growth (10% compound annual growth rate [CAGR]) was unable to keep up with the increase in reporting workload (30% CAGR) over this period. Additionally, the retention and recruitment of radiologists is a significant challenge for the NHS. The financial constraints placed on the NHS limit its ability to invest in trainee radiologists. With the demand for imaging growing at a faster rate than the supply of radiologists, radiology groups, imaging centers, and hospitals are increasingly becoming reliant on outsourcing their reporting workload.

The teleradiology business

Teleradiology involves an imaging center or hospital scanning a patient, and the image being stored in an imaging IT platform and securely transmitted to the teleradiology vendor. The teleradiologist reporter interprets the image before reporting back to the imaging center/hospital via the IT platform.

Teleradiologists are typically either full-time employees or part-time contractors, providing readings remotely from their home or office, either in their domestic country or internationally. From a teleradiologist's perspective, the benefits include the flexibility and convenience of working remotely, and for part-time teleradiologists the ability to provide reads alongside their primary roles as outpatient imaging radiologists.

Teleradiology vendors provide radiology groups, imaging centers, and hospitals with 24/7 reading services. Typically, 50% of demand for the U.K. and Ireland's teleradiology reading services are for out of hours, followed by overflow/capacity relief and routine reporting and, to a lesser extent, specialist reporting and quality/clinical auditing. Teleradiology vendors also provide reporting for all modalities (x-ray, CT, MRI, etc.) and clinical applications (neurology, cardiology, vascular, musculoskeletal, chest, abdomen, breast, etc.).

The cost of a teleradiology reading service depends on factors such as the length and complexity of the read, varying from a more affordable x-ray (average length, two minutes) to an MRI (average length, 20 minutes), which costs almost twice as much.

There are several advantages of outsourcing reporting workload to teleradiology vendors, including 24/7 availability, second opinions, cost efficiency, and fast turnaround times. In addition, teleradiology removes the distance/logistical barrier for radiologists and patients, particularly in rural locations, and provides timely access to subspecialists (e.g., neuroradiologist) during medical emergencies. For the outsourcers, the above factors comfortably outweigh any disadvantages, such as privacy concerns and miscommunication.

Market developments

In 2018, the U.K. and Ireland represented the fourth largest global region for teleradiology IT and reading services, with a market size of around 89 million euros. The penetration of teleradiology into the two countries' overall scan volume was 7.4% in 2018, representing the highest penetration globally. This growth is being driven by several factors:

- Number of imaging exams rising by 3% annually in the U.K.

- A move toward specialist modalities (MRI and CT)

- Increases in NHS workload and lack of radiologist capacity

- Increasing teleradiology penetration

- Rising revenues per read

Most of the U.K. and Ireland's leading teleradiology vendors are specialists in the provision of remote reading services. While outpatient groups also offer teleradiology reading services as part of their overall offering, this typically represents a relatively small share of an outpatient groups' revenue (i.e., < 5%), and the return on investment is relatively low.

Medica Group was the U.K. and Ireland's leading provider of teleradiology services in 2018, with 1.7 million diagnostic imaging reports, up 13.7% from 2017. Its revenue performance was even more impressive, rising by 15.6% year on year to 44 million euros. Medica's core business strategy involves working in partnership with NHS trusts (> 100 hospitals), clinics, private hospital groups, and diagnostic imaging firms. For its urgent care (NightHawk) reporting service, the company's average turnaround time was just 25.3 minutes. This is particularly important in an acute environment where an accurate and timely report can significantly improve a patient's chance of a positive outcome.

Additional leading teleradiology specialists in the U.K. and Ireland include Everlight Radiology, 4ways Healthcare, and Telemedicine Clinic (Unilabs).

Growth of artificial intelligence

While still in its infancy, artificial intelligence (AI) has the potential to increase the volume of imaging procedures performed by improving radiologist productivity and efficiency, reducing errors and supporting patient triage, escalating studies within a radiologist's queue, or changing the priority of a study from a nonemergency to an emergency.

AI developments have been particularly prevalent across the Atlantic, with several U.S. teleradiology vendors (including vRad) collaborating with AI software/algorithm developers on studies. These have included AI tools that increase the speed of MRI examinations, and the development of an algorithm for detection and worklist prioritization of intercranial hemorrhage on head CT scans.

Image augmentation algorithms are also being developed to retrospectively enhance image quality in postprocessing and detect previously undetectable image features. In addition, the facilitation of quicker image acquisition will reduce the dosage of scan radiation on the patient, ultimately increasing the universe of patients suitable for diagnostic imaging and, therefore, increasing examination volumes.

In the U.K., Behold.ai is an example of a radiology AI specialist implementing its algorithms in NHS trusts; in June 2019, it partnered with Dartford and Gravesham to prioritize workloads and reduce reporting backlogs.

While AI has the potential to support the deployment of x-rays for triage and to support radiologist decisions, the use of AI tools in diagnostic imaging appears most valuable in specialist and urgent areas (e.g., MRI and CT), where reporting times are substantially longer and the visibility of images and abnormalities can be particularly challenging to interpret.

Arun Gill of Signify Research.

Arun Gill of Signify Research.We believe the teleradiology vendors are best placed to collaborate with AI developers and deliver AI tools to imaging centers and hospitals, who are more likely to continue outsourcing diagnostic imaging workload, rather than invest in developing the technology themselves. The AI opportunity for teleradiology vendors is significant and has the potential to drive efficiencies, increasing teleradiologist capacity to provide reads and ultimately improving revenues and timely/accurate diagnosis.

However, several barriers need to be overcome (including the regulatory process and lack of commercial AI deployments) before AI becomes mainstream in diagnostic imaging; therefore, the impact of AI will be minimal in the next five years.

Arun Gill is a senior market analyst who leads the section on integrated care IT, EHR/EMR, and telehealth at Signify Research, a health tech, market intelligence firm based in Cranfield, U.K.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.