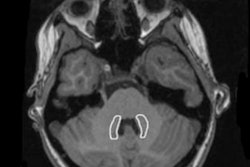

The recommendation by the European Medicines Agency (EMA) on 10 March that market authorization for four linear gadolinium contrast agents (GBCAs) be suspended shocked the radiology community, but very little has been said about this decision's effect on businesses.

Supply of the agents in question is significant business for Bayer HealthCare Pharmaceuticals (Magnevist), GE Healthcare (Omniscan), Bracco (MultiHance), and Guerbet (Optimark), and Europe's one of their largest and most mature marketplaces. So, what will be the market repercussions?

Fight or flight? It's not all black and white

The information offered with the EMA announcement provides a few clues about how the market will react. However, it's clear that a swift reversal of the recommendation and soon-expected EMA suspension is unlikely.

Stephen Holloway is a principal analyst and the company director at Signify Research.

Stephen Holloway is a principal analyst and the company director at Signify Research.Moreover, would such a recommendation have been made if the vendors had robust clinical evidence to hand that could demonstrate gadolinium deposited in the brain had no clinical effect? Probably not, in which case there are some difficult decisions for the vendors to make. Should they look to overturn the EMA decision, or cut their losses?

The removal of a profitable multimillion euro product line is a sizeable hit for each vendor and not one they will take lying down. However, overturning the forthcoming EMA suspension will require significant financial input into large-scale clinical trials, with little certainty of an overturned result.

New clinical evidence will need to prove safety of use above that already available, and a case made that there are no viable therapeutic alternatives available today, a propensity in most EMA rulings. This is no easy task, especially considering most vendors already have a macrocyclic gadolinium contrast agent on the market today.

The U.S. Food and Drug Administration (FDA) will also be a significant factor in vendor strategy. The U.S. remains the largest market for medical imaging and so far, the FDA has taken a "wait-and-see" approach to linear gadolinium agents until better clinical evidence is available. Therefore, vendors also must keep in mind that pushing the issue on the European front could also lead to a change in FDA position and with it, the potential tightening of regulations in the U.S., their largest marketplace.

Instead then, it is more likely vendors will rapidly pivot customers from linear to macrocyclic agents in Europe, thereby limiting the impact and the risks that fighting the EMA decision would incur.

Perception matters

There are other considerations that may be of more concern for the vendors.

Physician perception of gadolinium contrast agents is changing, with a number already moving away from use and becoming increasingly vociferous in opposing linear agents. While this may be hype -- or gadolinium "fever" or "phobia," as it is increasingly known -- a change in the tide of clinical perception is a concern for vendors. All of them have other allied products and interests in the field of medical imaging, either in supply of other contrast agents and pharmaceuticals (Bayer Health, Bracco Imaging, Guerbet) or in supply of medical imaging hardware and other agents (GE Healthcare).

If perception toward gadolinium contrast agents continues to degrade, each vendor will need also to consider their wider business interests. Will being associated as a protagonist of linear gadolinium contrast agents harm future sales in their other product lines? Or is it better to avoid the risk altogether, and with it write off a lucrative product line?

All for one and none for all

Vendor response to the decision has been mixed or nonexistent, further adding to market uncertainty. GE Healthcare vowed to appeal against the decision and bring new clinical evidence, Guerbet came out in support of the decision, Bracco took note of the decision but reiterated linear GBCAs are still authorized for use, and Bayer has yet to offer public comment at the time of writing.

Such a mixed response appears to offer a pointer as to each vendor's appetite for risk and exposure to loss from the EMA decision. For Bayer, Bracco, and Guerbet, all have well-established macrocyclic alternatives in the market already, softening the blow of the EMA decision. For Bayer, too, GBCA supply to imaging is one small part of a large pharmaceutical, consumer crop science conglomerate, so risking a long-term locking of horns with the EMA may not be advisable.

For GE Healthcare, who has released its own macrocyclic GBCA at ECR 2017 earlier this month, the decision to appeal against the EMA suspension is perhaps a reflection that it has had little time for a preemptive transition of customers from linear GBCAs, thus a suspension would be a significant loss. However, with a multibillion euro imaging modality hardware and IT business in Europe, any further shift in physician or patient perception against linear agents, or worse, a consequent impact on other business lines, will no doubt put an end to any significant battle with the EMA.

The next few months promise to be intriguing. Watch this space.

Stephen Holloway is a principal analyst and the company director at Signify Research (www.signifyresearch.net), a health tech, market-intelligence firm based in Cranfield, U.K.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.