As ECR 2014 approaches, now is a good time to consider the key trends in the medical imaging market. Below are our main predictions for this year in digital x-ray, ultrasound, and CT/MRI.

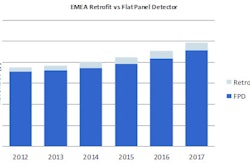

Prediction 1: Retrofit solutions in DR only provide short-term solutions

Hype surrounding retrofit flat-panel detector (FPD) digital radiography (DR) upgrades for existing analog, computed radiography, and mobile x-ray systems has dominated the general radiography x-ray market for the last two years. Yet, retrofit solutions only offer short-term benefits as a stop-gap solution for some user groups.

It is true that upgrading to flat-panel technology offers significant benefits in terms of efficiency and lower radiation dose, at a price point approximately 50% lower than a new DR system. For users in small hospitals and clinics with limited budgets and little access to credit, this may be the only option for DR technology for the next three to five years.

But for the majority of users in large and mid-sized hospitals, extending the lifecycle of aging analog systems may not be as advantageous. The main focus of these users during austere times is on efficiency, flexibility, and workflow. Aging systems often lack newer features such as automated positioning and integration with healthcare IT systems, often making a brand-new system more cost-effective in the long term, despite the initial higher systems price.

Complications in terms of the servicing and legality of retrofitted solutions have also limited demand. Therefore, retrofit upgrades appear to be a knee-jerk reaction to economic challenges of late, offering the most to users in small clinics or with lower patient volumes. For larger hospital suppliers, long-term gains provided with replacement flat-panel DR systems is the most attractive option.

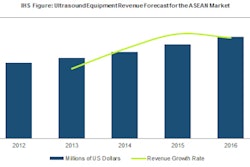

Prediction 2: Long-term saving is key focus for ultrasound, but innovation will suffer

Cost management among healthcare providers has reshaped the ultrasound market after a rapid diversification of clinical use. While expectation of system image quality and standards has steadily increased, user focus has shifted away from advanced features toward improvements in workflow, user interface, and efficiency. Smarter features such as automeasurement, predefined settings, and touch interfaces are becoming increasingly common, offering significant long-term cost savings.

This has been most prominent in the swathe of new point-of-care applications, where systems are increasingly used for procedural guidance rather than complex diagnosis. This trend has undoubtedly been at the cost of brand-new ultrasound technology innovation, with suppliers realigning research and development priorities toward efficiency rather than cutting-edge diagnostic technology.

Looking to 2014, this trend will continue, with user focus remaining on replacement of aging systems with smarter, more efficient systems. The relatively low cost of ultrasound compared with other modalities will further drive steady demand, assuming vendors can provide evidence of long-term cost savings provided with ultrasound.

Prediction 3: Specialty use of advanced imaging systems to alleviate healthcare spending crunch

Advanced imaging systems such as MRI and CT have been the scapegoats for overspending on medical imaging in the last five years, reflected in the significant decline observed in these markets over the 2009-2012 period. Overutilization and self-referral in the U.S. market prompted significant scrutiny on use and spending on advanced imaging, resulting in dramatic cuts and new guidelines last year.

Outside the U.S., dire economic conditions in Western Europe further impacted market demand, offset in part by growth in China and Southeast Asia. Innovation has also been sluggish, with the only notable major developments offering new "silent" MRI systems and in the final emergence of detailed MRI imaging of the liver.

Despite these developments, end-user need for cost savings will continue and intensify, with most imaging sites focusing on more creative solutions to cut costs. In the short term, system demand will remain subdued, as budget restrictions will continue to limit new or replacement systems.

Users are also becoming more creative in maximizing opportunity for advanced imaging. Use of application-specific systems is predicted to become increasingly common, particularly in large hospitals. Systems designated for emergency medicine, cardiology, or extremity imaging offer significant benefits in terms of cost in the short term, reducing pressure on multiapplication systems and increasing total patient volume.

The key challenge is in user education, with many healthcare providers unaware of the significant advances and benefits of extremity MRI or nondental cone-beam CT outside of niche applications. Longer term, replacement of the aging installed base of multimodality "workhorse" scanners will become an increasing priority, especially as integration with healthcare IT networks is more vital for healthcare providers.

Editor's Note: These predictions were made in the Top Healthcare Technology Trend Predictions for 2014, from IHS Medical Devices & Healthcare IT.

Stephen Holloway is associate director, and Nicola Goatman, Sarah Jones, and Benjamin Niu are analysts for medical imaging equipment, all with IHS Technology.