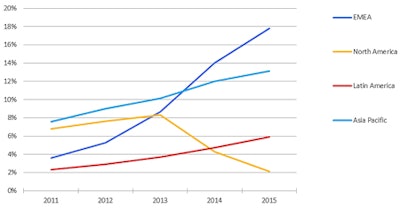

While the PACS markets in most developed regions have reached a point of high saturation, the worldwide market for cardiovascular information systems (CVIS) and radiology information systems (RIS) is expected to be worth $600 million in 2012.

Pockets of strong growth for PACS do remain in emerging areas, such as projections for an average of 150 new large-scale PACS installations each year in the Asia-Pacific region over the next five years. In Western Europe and North America, however, CVIS and RIS offer PACS vendors opportunities for important new revenue streams as well as difficult challenges, according to research by InMedica.

CVIS

Growth in the cardiology IT market is to be expected as hospitals broaden their IT focus beyond radiology. This is occurring alongside the push for electronic health records (EHRs), particularly in the U.S. As EHR penetration increases, healthcare providers are beginning to improve their utilization of these systems. The meaningful use and accountable care organization (ACO) initiatives in the U.S. have hospitals thinking more about optimization, not just implementation.

Once a hospital realizes the need to optimize EHR usage, it starts asking questions about connectivity to all departments and then image access within the EHR. With cardiology as one of the largest revenue generators in most hospitals, demand for improved access to cardiology information and enhanced cardio-workflow is growing.

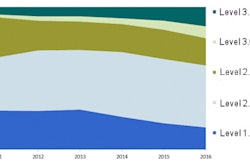

|

| World market for CVIS by geographic region -- revenue growth. Image courtesy of InMedica -- World Market for PACS RIS CVIS - 2011. |

Within cardiology, cardiology PACS represents less of a vertical shift for traditional radiology PACS suppliers. Many of these vendors have a cardiology PACS product and have been able to dominate revenues in the cardiology PACS market over the past five years. In 2010, the leading radiology PACS suppliers -- Agfa HealthCare, Siemens Healthcare, Philips Healthcare, McKesson, Fujifilm, Carestream Health, and GE Healthcare -- collectively accounted for more than 75% of revenues in the global cardiology PACS market.

The fragmented CVIS market presents a bigger challenge, however. CVIS has not traditionally been a major focus area for many PACS vendors. Moreover, in many cases, PACS vendors have expanded their cardiology PACS offerings to include some measurement, analysis, and reporting functions, which fulfilled some, although a very small proportion, of what a CVIS should achieve within a cardiology department.

As such, specialist providers stepped in to fulfill the needs of cardiology workflow. A true CVIS should, in the simplest form, work like a RIS within cardiology, providing scheduling and access to the complete and detailed records of all cardiac patients across the cardiovascular care continuum.

CVIS should also capture data during diagnostic/therapeutic procedures and all patient encounters with modules from lab, charting, pacing, stress, chest pain, respiratory, outpatient clinic, and rehab, as well as interface with cardiology PACS and enterprise systems such as EHR.

It hence serves as the critical central platform for cardiac data. To fully capitalize on hospitals' shift of focus to cardiac workflow, PACS vendors are projected to increase their presence in the CVIS market.

RIS

One of the most fragmented of all imaging IT segments, RIS presents a different kind of opportunity and challenge for vendors. Collectively, the leading PACS suppliers were estimated to account for less than 33% of revenues in the global RIS market in 2010.

In each country, local independent RIS suppliers are able to dominate revenues. In Western Europe, for example, the second largest RIS supplier in 2010 was estimated to be El.Co, mainly through its activities in Italy. Other leaders include Medavis (Germany) and Healthcare Software Systems (HSS) (U.K). Although the RIS market is just as saturated as the PACS market in developed regions, this fragmentation means PACS vendors have significantly lower RIS revenues.

Similar to cardiology, the role of the departmental information system in enabling connection to the hospital enterprise is increasingly important in radiology. Subsequently, RIS replacement rates are forecast to be higher than PACS replacement rates, and hospitals are looking to traditional PACS vendors to achieve greater synergies.

The strong position of local RIS providers, however, means PACS vendors face much stronger competition in the RIS market. Adapting RIS systems to incorporate local billing and registry requirements for each country will also prove a significant barrier to multinational PACS vendors.

While PACS replacement in developed regions and strong growth in emerging areas will generate continued opportunities for suppliers, there is an increasing need to diversify and provide an integrated solution for radiology and cardiology. As such, the RIS and CVIS markets will become more important to PACS vendors. However, the larger number of suppliers and strength of established competing products will remain a considerable hurdle to overcome in order to reach this potential revenue stream.

Theo Ahadome is lead market analyst for healthcare IT at InMedica (in-medica.com), the medical research division of IMS Research. The information in this article is obtained from InMedica's research on healthcare IT markets, including PACS, RIS, CVIS, enterprise management, cloud storage, and vendor-neutral archives. He can be reached at: [email protected].

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnie.com or AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.

Editor's note: Somatom Definition cardiac image on home page is courtesy of Siemens.