Buoyed by its perceived superiority over PET/CT, early adopters of PET/MRI believe the hybrid modality could be used more often in routine clinical applications within the next five years. However, that predicted growth could hit a speed bump because of PET/MRI's hefty operational costs and longer scan times, according to a paper published online August 11 in the Journal of Nuclear Medicine.

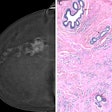

An international survey of over three dozen clinical and academic research institutions found that more than 50% of respondents predicted PET/MRI will have a "profound clinical impact" within five years. So far, oncology and neurology are the most widely targeted applications for PET/MRI, with anticipated future use in cardiovascular disease and for imaging inflammation (JNM, August 11, 2016).

"From a research point of view, PET/MRI is an absolutely fascinating and interesting tool," said study co-author Dr. Ken Herrmann, chair of nuclear medicine at Universitätsklinikum Essen in Germany. "There is also general optimism because all technical revolutions eventually make it into daily clinical practice."

PET/MRI adoption

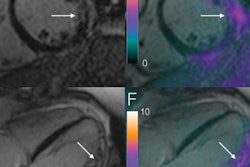

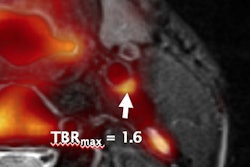

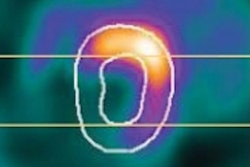

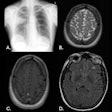

Since its first commercial installation in 2011, the number of facilities housing PET/MRI systems has increased to 70 worldwide, according to the paper. The near-simultaneous acquisition of PET's molecular images and high-resolution anatomical MR images of soft-tissue contrast has been the enticing lure of the modality.

Dr. Ken Herrmann from Universitätsklinikum Essen.

Dr. Ken Herrmann from Universitätsklinikum Essen.To better gauge PET/MRI's early adoption and utilization, Herrmann and colleagues from the University of California, Los Angeles distributed the survey to 69 active PET/MRI users between June and October 2015. The survey had 26 questions that covered three primary topics: the operation of the PET/MRI centers, current applications and imaging protocols, and perspectives on future applications.

A total of 39 responses were received, with the majority from Europe (24, 62%), followed by North America (9, 23%) and the Asia-Pacific region (6, 16%). PET/MRI was performed equally as often for clinical and research purposes, with most PET/MRI systems (26, 67%) located in public institutions with an academic focus. The sites had operated PET/MRI systems for a median of 30 months.

By far, oncology was the primary application for PET/MRI at both clinical (88%) and research (76%) imaging centers, followed by neurology at 9% and 12%, respectively. Several centers operated PET/MRI for clinical (13%) or research purposes (19%) only.

No survey participants listed cardiovascular disease among the applications currently being performed, although seven respondents use the modality for cardiovascular imaging to diagnose cardiac fibrosis, atherosclerosis, or vasculitis.

Among the respondents, 30 facilities operate PET/MRI systems from Siemens Healthineers (77%), followed by nine (13%) with Philips Healthcare systems and seven (10%) with GE Healthcare systems.

Who has the read?

Given the hybrid nature of the images, interpretations were performed collaboratively by radiologists and nuclear medicine physicians at 30 (77%) of the responding sites. This finding made "absolute sense" to Herrmann, who endorsed joint reading by specialists or someone trained in both modalities.

"I was most surprised that in some sites only radiologists or only nuclear medicine people were reporting these studies," he said. "In 13% of the centers, only radiologists interpreted PET/MRI, and at one center only the nuclear medicine person read the hybrid images."

The survey results did reveal one significant challenge to the expanded adoption of PET/MRI. The length of time to complete a typical PET/MRI protocol is 45 to 60 minutes, which is approximately twice as long as with PET/CT. The additional time can create issues for both the patient's well-being and the imaging center's business model.

Herrmann estimated that the purchase price of a PET/MRI system is between $4 million and $5 million. Annual maintenance would add another 10% to the cost, plus salaries for two or three technologists. Based on PET/MRI's extended scan time, a facility can anticipate imaging only eight to 10 patients per day or 40 to 50 patients over a five-day period.

"The amount of scans is very much limited by the duration of scans. This is the main issue between PET/CT and PET/MRI," Herrmann said. "As long as PET/MRI takes an hour, you are limited to eight to 10 patients per day. At 250 days per year, that is a maximum of 2,500 patients. It is very, very difficult to break even with this limitation."

In the paper, the researchers noted that a total of 44,706 patients underwent PET/MRI at the 39 sites. By dividing that total number of patients by the number of weeks of operation for each site, they calculated an average of eight patients undergoing PET/MRI per week, with a maximum throughput of 38 patients per week.

Lack of reimbursement

The economics are made even more onerous because there is no formal reimbursement route for PET/MRI scans. Anecdotally speaking, some imaging facilities have billed separately for PET and MRI scans.

"I imagine that they were reimbursed for PET or MRI, which covered part of the cost, but I am not aware of any institution that was getting full reimbursement for dedicated PET/MRI," Herrmann said.

The weight of the hefty acquisition price tag was lightened somewhat in Western Europe, where research funding helped many installations with PET/MRI costs, according to the authors. Overall, hospital (26%), private (28%), and research funds (28%) were cited as leading sources of financing for PET/MRI. Governments provided the main funds for 18% of sites.

"The low patient throughput and the amount of public and research funding raises questions about the financial viability of privately operated systems," they wrote.

Patient factor

Adding significant additional scan time with PET/MRI versus PET/CT is a concern for patients who are ill or find it difficult to remain still for a long time.

The survey respondents cited various MR imaging techniques, such as diffusion-weighted imaging (DWI), fluid-attenuated inversion recovery (FLAIR), T1- and T2-weighted acquisition, and volumetric interpolated breath-hold examination (VIBE), for neurologic and oncologic imaging as reasons for the longer scan times.

In addition, Herrmann and colleagues suggested that a "harmonization of specific protocols may be of use in demonstrating clinical utility needed to accelerate PET/MRI adoption."

Given PET/MRI's potential and challenges, 28 respondents (72%) expect utilization to increase in the next three to five years. They cited its "superiority over PET/CT" and "unique clinical information" as the primary drivers for adoption, followed by cost, combined functional MRI and PET, and patient throughput.