Cost -- that is the key factor affecting the advanced medical imaging market. For the MRI market it comes in many guises: upfront, operational, installation, services. All of these influence the purchasing decisions of hospitals globally and continue to stifle growth in the global MRI market. When systems cost upwards of 700,000 euros, each contributing factor is magnified in importance.

The "bread and butter" of the MRI sector are cylindrical systems. These account for approximately 75% of the global MRI market. 1.5-tesla, 3-tesla, and 7-tesla magnets have all been the focus of innovation in recent years and certainly have their place for numerous clinical applications. However, the future progression of the market will be focused on the 1.5-tesla segment.

The 3-tesla market was tipped for strong growth three years ago, driven by promises of improved resolution and diagnostic outcomes. However, improvements in 1.5-tesla systems accelerated through demand for more advanced mid-priced systems, as well as concerns over the price of 3-tesla equipment. The 1.5-tesla market also meets the needs of both emerging and developed markets as it splits to include a multitude of price tiers offering premium and economy systems. In 2014, the global average selling price of 1.5-tesla systems was two-thirds that of 3-tesla systems, and this is not expected to change over the coming five years. As a result, the 3-telsa market will remain a smaller, more specialized segment as 1.5-tesla systems drive the majority of unit growth.

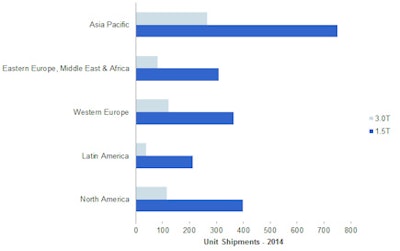

Unit shipments of 1.5- and 3-tesla systems in 2014.

Unit shipments of 1.5- and 3-tesla systems in 2014.The 1.5-tesla systems are projected to remain the majority of the market for the foreseeable future. The developed markets of North America and Western Europe are almost exclusively replacement markets looking for cost-effective systems that provide adequate image resolution and clinical outcomes. The 1.5-tesla systems meet the requirements of the core hospital market, and increasingly 3-tesla systems are only required by specialty and training hospitals, which account for approximately 10% to 15% of the total market.

Manufacturers are now focusing on improving the operational costs and user experiences of the systems. Reducing cost, noise, and footprint of 1.5-tesla whole-body systems has the potential to boost growth in smaller practices outside of specialist institutions where extremity MRI scanners may be prioritized.

As a result, a succession of products launched in the last two years has focused on four key areas: cost of ownership, noise reduction, small footprint, and wider bore for increased patient throughput. These include:

Toshiba Medical Systems -- The 1.5-tesla Vantage Elan scanner offers a 64-cm bore with numerous features typically found in a more expensive system, including noise-reduction technology.

Siemens Healthcare -- Magnetom Amira is a recently launched Siemens scanner that is a high-functionality 1.5-tesla system at an affordable price point.

GE Healthcare -- Signa Creator and Signa Explorer systems were launched at ECR 2015, offering smaller footprint, reduced energy consumption, and lower cost of ownership.

Philips Healthcare -- Ingenia 1.5TS offers improved patient experience and advanced image quality in a 1.5-tesla system.

Hitachi Medical Systems, a leader in the open MRI segment, has a strong product offering in the form of the Echelon Oval 1.5-tesla scanner, launched in 2012.

Investment in new advanced imaging solutions is currently being focused on CT due to the need for new equipment that offers radiation dose reduction software and tracking. As a result, short-term growth in the MRI market is low due to lack of investment. However, interest in 1.5-tesla systems is projected to accelerate over the next four years, with the global average annual growth rate for units peaking at 11% in 2015.

Growth is projected to be led by the Eastern Europe, Middle East, and Africa market, as well as in Asia where the penetration of MRI systems is low. The North American market remains challenging due to changes in reimbursement, and as a result, growth is significantly lower. However, even in this challenging market, adoption of 1.5-tesla systems is projected to be far stronger than that of 3-tesla and open MRI equipment.

The total EMEA market comprising Western Europe and Eastern Europe, Middle East, and Africa provides a good example of the popularity of 1.5-tesla systems for both emerging and developed markets. As the Western European market recovers from economic turmoil, cost is an ever important factor in purchasing decisions. As a result, advanced 1.5-tesla systems are projected to account for a far higher proportion of unit shipments compared with 3-tesla systems over the next five years. Likewise, the 1.5-tesla market is projected to drive growth in the developing Eastern Europe, Middle East, and Africa market, with unit shipment growth for 1.5-tesla systems estimated at 17% in 2015 compared with 10% for 3-tesla systems.

Cost will therefore remain the key purchasing decision in the MRI market over the next five years. Whilst restricted healthcare spending may appear to cast a shadow over the high-cost medical imaging market, it could also act as a catalyst for innovation in a market that is searching for cost-effective imaging solutions.

Nicola Goatman is a senior analyst with IHS Medical Technology. IHS Medical Technology provides market research and consultancy services to the medical device industry. Coverage includes medical imaging equipment, clinical care devices, healthcare IT, consumer medical devices, medical displays, and wearable technologies.

Originally published in ECR Today on 5 March 2015.

Copyright © 2015 European Society of Radiology