Belgian investment firm Groupe Bruxelles Lambert (GBL) announced on 19 April that it is making its first sizable investment in healthcare by acquiring imaging operator Affidea for approximately 1 billion euros.

GBL has agreed to acquire a majority stake in Affidea from B-Flexion, the Geneva-based private investment firm that is chaired by biotech entrepreneur Ernesto Bertarelli. The main attraction is the sector's "resilience to economic cycles and long term underlying growth trends," and the deal is expected to be completed in the third quarter of 2022, according to a press release issued by GBL.

The company said it "will strive to accelerate organic growth, mergers and acquisitions, and digital health programs" and "will support Affidea in the development of high-quality medical services in the interest of all of its stakeholders -- patients, doctors, and regulators."

Evolving market in Europe

"This is an interesting move," an industry expert told AuntMinnieEurope.com. "There is significant potential in these types of healthcare enterprises, especially for imaging and laboratory examinations."

The European market for imaging services seems to be evolving in a similar way to the U.S., with more services provided or outsourced to larger groups. Efficiency gains and cost savings can often be made in this way, without decreasing profitability, the observer noted.

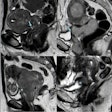

Founded in 1991, the Dutch-based Affidea Group operates 320 imaging centers across 15 countries, providing medical services to over 10 million patients a year. Its recent acquisitions in Europe include Promea, CDC Group, and Radiological Center Lodigiano in Italy; Medicentro outpatient center in Spain; Fortius sports medicine clinic in the U.K.; and the Orthoderm and Hillsborough outpatient providers in Northern Ireland. Over 7,500 medical doctors work at its sites.

On 12 April, Affidea announced the acquisition of a majority stake of Brust-Zentrum Zürich, the largest integrated breast medicine group in Switzerland. In Switzerland, the combined business of Affidea and Brust-Zentrum Zürich brings together more than 280 professionals in 11 centers, seeing more than 145,000 patients every year, according to the company.

Brussels listing

GBL is listed on the Euronext Brussels stock exchange and is included in BEL20, the benchmark stock market index of the Brussels exchange. The firm had a net asset value of 22.5 billion euros and a market capitalization of 15.3 billion euros at the end of December 2021.

According to an article posted on 17 April by Bloomberg, GBL was largely built by the deceased Belgian billionaire Albert Frere, who turned his family's nails and chain business into an empire stretching from energy to alcohol. Frere held interests in oil producer Total and distiller Pernod Ricard.

GBL appointed Ian Gallienne as its sole CEO in December 2018, shortly after the death of Frere, Gallienne's father-in-law. The firm is still backed by the Frere family and Canada's Desmarais clan. Its shares have slid 4.5% this year, Bloomberg stated.

Most of the Bertarelli family's fortune came from the $8.6 billion sale of fertility drug manufacturer Serono to Merck in 2006, according to the Bloomberg Billionaires Index. Most of the proceeds were reinvested through B-Flexion, whose assets include commercial real estate in London and Switzerland as well as technology-focused venture funds Forestay Capital and Kedge Capital (which invests in private equity and hedge funds).