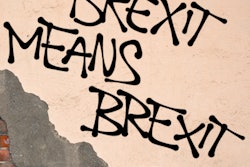

The U.K. referendum decision to leave the European Union (EU) has sent shockwaves through the global med-tech community. National politics are in disarray, markets are twitchy, and uncertainty is rife. Accurate market predictions post-Brexit ("British exit") are tough, but I've given it my best shot.

First, let's consider three key factors that will have the greatest impact on medical imaging and healthcare IT in the short- to midterm and dig a bit deeper into likely outcomes.

Short-term impact on the NHS

The short-term fallout for the National Health Service (NHS) will be minimal in terms of procurement demand. Existing contracts will continue as planned and budgets unchanged -- for 2016 and early 2017 at least. No deals have been hit thus far by the falling U.K. currency, though it will have hurt some vendors' pockets importing in from non-EU markets due to currency fluctuations as a result of the initial Brexit shock. The threat of a U.K. government emergency budget appears to have disappeared, suggesting there will be no budgetary surprises for health funding straightaway.

Of most immediate concern are reports of intensifying staffing issues, especially in filling consultant physician roles, including radiologists. Talk of EU-migrant candidates pulling out of NHS consultant applications is a worrying trend for an already under-resourced NHS clinical staff.

This concern was further backed up by multiple statements from government health officials and physician associations looking to reassure current EU-migrant NHS staff that their right to work and live in the U.K. remains unchanged. Whether this does enough to reassure current staff remains to be seen, but it looks likely the EU-migrant recruitment intake will slow amongst ongoing uncertainty and suggests the free movement of radiologists in and out of the U.K. will be questionable moving forward.

Regulations and imports

How the U.K. will extract itself from the harmonized EU regulations is also unknown today. EU medical device regulations are currently embedded in U.K. law. Changing the current process would require an act of U.K. parliament to amend, and this is unlikely to occur soon, given the current political infighting. EU law also enforces and restricts anticompetitive behavior from both NHS procurement and market vendors, and removing this could lead to less fair NHS procurement.

Initial guidance suggests the U.K. Ministry of Health will need to review all current EU medical device regulation and decide whether to adopt it as standard or amend and enforce new U.K.-only regulation.

While the prudent move would be the retention of most of the existing regulations, it will be a lengthy and complex process, especially with staffing resources planned to be cut by a third as part of ongoing budget cuts. For vendors and users, that also means more uncertainty on procurement schedules and potential for some nasty regulatory surprises down the line.

The U.K. & wider EU economy

Above all, market direction and demand will be heavily dependent on economic performance. If we dismiss the initial "rebalancing" of the stock market in the immediate aftermath of the Brexit vote, the likely U.K. and EU economic outlook will be a hit to performance of between 1% to 3% of GDP and a heightened risk of recession.

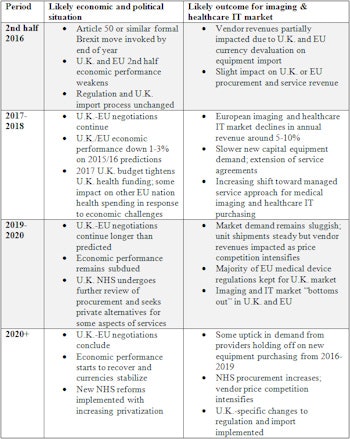

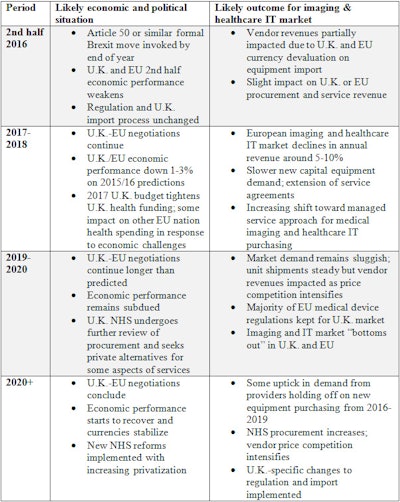

For medical imaging and health IT vendors, this means a tough period ahead in European markets. While it is still very early to provide a solid forecast, my broad timeline and top-level expectations for market reactions is shown in the table.

Expectations and reactions.

MRI's future outlook

In more positive news, the long-term future of MRI has been assured with the discovery of a new source of helium in Africa. Unknown to many (myself included), helium resources have been fast running out, with some predictions suggesting depletion by 2040. Instead, it looks like MRI will be here for the majority of the next century. This is great news for radiologists, patients, and market vendors for sure.

The news also got me thinking about the advancement of MRI-based clinical diagnoses and subsequent market impact. Rarely does a week go past where stunning new MRI images and findings are celebrated and discussed; a recent 3D neuro MR angiography visualization blew my mind! But in reality, cutting edge systems capable of such advanced MRI studies remain specialized and a small proportion of units shipped each year.

Instead, the majority of market demand has been for lower-cost, more efficient MRI. In the 1.5-tesla segment, we have also seen the establishment of two clear user categories; lower-cost "value-MRI" (for smaller clinics and hospitals with basic and routine imaging needs); and "workhorse" 1.5-tesla systems designed for larger hospitals and higher patient throughput.

Both have rapidly expanded access and affordability of MRI making it (almost) an everyday imaging modality, something often forgotten. Also forgotten is the concerning aging installed base of equipment across Western Europe. According to the 2014 COCIR Medical Imaging Equipment Age Profile & Density report (citing data from 2013 and the most recent comprehensive study I am aware of), almost 20% of currently installed MRI systems in Europe are more than 10 years old. Given the current economic outlook, this is likely to worsen in the coming years.

So the question for the industry remains: Should the focus be on continuing to broaden affordability, access, and quality of MR systems, or push the boundaries of what is possible? In the short- to midterm, expect more focus on the latter, unless you are Mary Lou Jepsen of course...

Stephen Holloway is a healthcare technology industry expert based in Northampton, U.K. He was formerly associate director, Medical Devices & Healthcare IT, IHS.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.