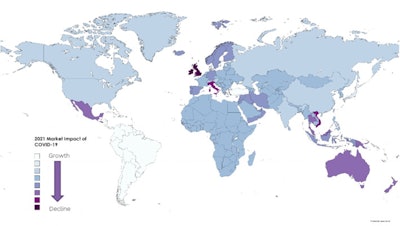

After the market disruption caused by the COVID-19 pandemic in 2020, the world ultrasound market is forecast to recover in 2021, with most markets expected to grow. The main regional growth trends are discussed below.

Western Europe: Market boosted by emergency tenders

Fueled by COVID-related tenders, the Western European ultrasound market grew at a double-digit annual rate in 2020. All countries in the region saw market growth, except for Benelux, which was estimated to have declined. With far fewer COVID-related tenders expected in 2021, the Western European market is forecast to decline, with the biggest decline predicted for the U.K. due to the exceptionally strong growth seen in 2020.

While overall the Western European market will decline in 2021, some Western European governments have rolled out schemes that will boost the market in their country. This includes the COVID-19 investment premium in Austria and the Hospital Future Act in Germany.

Eastern Europe, Middle East, and Africa: Russia driving growth

The Eastern European ultrasound market was estimated to have grown in 2020 and is forecast to grow again in 2021. This is largely due to the performance of the Russian market, where there is a large lifecycle deal in Moscow running across 2020 and 2021 worth around $120 million.

All of the major markets in the Middle East and Africa region, including Iran, Turkey, and Saudi Arabia, are estimated to have declined in 2020. The Middle East region has been hit hard by the combination of the COVID-19 pandemic, the plunge in oil prices, and various ongoing conflicts.

As such, following a steep decline in 2020, the ultrasound market is forecast to experience another decline in 2021. The main exceptions are Turkey, where a large Ministry of Health tender funded by the European Bank for Reconstruction and Development (EBRD) will boost the market, and Saudi Arabia, which is poised for growth due to pent-up demand and the need to replace aging systems. The overall Middle East and Africa region is forecast to recover to 2019 revenue levels by 2024.

The African market declined in 2020, primarily due to steep market declines in Egypt and South Africa, and it is forecast to return to growth in 2021. The women's health market continues to be a growth driver in many African countries. Low-end and midrange systems continue to be the fastest growth product categories.

Latin America: One of the weakest links

Latin America (LATAM) has been one of the worst affected regions by the COVID-19 pandemic, largely due to poor government response, which has been blamed for the depreciation of local currencies.

While the COVID-19 situation has worsened in Brazil in 2021, leading to a continued decline for the ultrasound market in the first quarter, the outlook for the rest of the year is more positive. Customers are now more accustomed to the volatile market conditions and are being more aggressive in their spending plans as they look for opportunities to grow. As a result, strong growth is forecast for Brazil in 2021.

The ultrasound market in Mexico, on the other hand, is forecast to further decline in 2021. Though it has not seen the same increased COVID cases and deaths as in Brazil this year, the country is still suffering from the pandemic, with the COVID-19 vaccination program progressing slowly with under 30% of the population fully vaccinated as of September 2021. While the government has continued to issue tenders for ultrasound equipment, they are not the same size as in previous years.

The rest of the LATAM region has not been as affected by COVID-19 as Brazil and Mexico, and the ultrasound market is forecast for a near full recovery to 2019 levels in 2021. Argentina is expected to be one of the main growth drivers in the region.

China: Market growing in 2021, but not as fast as in recent years

In 2020, the Chinese market is estimated to have declined by around 10%. The market is expected to bounce back in 2021, with high single-digit growth forecast. Drivers of growth in the coming years will be through government investment into rural healthcare and an upward shift in the ultrasound product mix to more sophisticated systems in nonmajor city urban areas.

In May 2021, because of the census in 2020 that showed a steep decline in birth rates, the government further relaxed its two-child policy by allowing families to have up to three children. This is expected to lead to a short-term spike in demand for ultrasound systems, as seen when the two-child policy was introduced in 2016.

Japan: Government supplemental budget drives 2021 recovery

The ultrasound market in Japan declined by 2.5% in 2020. This was due to a combination of customers bringing forward purchases in 2019 to avoid the tax increase at the end of the year, and the impact of the COVID-19 pandemic.

An emergency supplemental budget was announced by the Japanese government at the end of 2020. This budget includes 10 billion yen ($90 million) for ultrasound equipment, which was released in the first quarter of 2021, with another smaller budget to be released in the third quarter of 2021. This initiative is primarily targeted at the point-of-care market, with a $100,000 cap on the systems purchased with this budget. Some of the budget will also be used for the radiology and cardiology markets, with no cap on system prices. As a result, the Japanese market is forecast to fully recover to 2019 revenue levels in 2021.

Southeast Asia: A mixed bag, but most regions declining

Largest growth in the rest of the Asia region in 2020 was seen in Indonesia, Australia, and Thailand. The growth was driven by panic buying of ultrasound systems by hospitals in Australia in response to the pandemic as well as the introduction of a tax incentive to purchase new systems, and large public tenders in Indonesia and Thailand. Most of the bigger markets in the Southeast Asia region are forecast to decline in 2021, due to either continued impact from the COVID-19 pandemic or a correction from the inflated growth in 2020. The political instability in countries such as Malaysia and Vietnam is another reason these countries are forecast to decline in 2021.

North America: Strong recovery for premium systems

The U.S. ultrasound market declined in 2020, with premium systems experiencing the steepest market drop. The decline was driven by the impact of the COVID-19 pandemic and the resultant reallocation and reprioritization of budgets to frontline COVID care. Sales activity was also restricted as vendors were unable to visit health providers for much of the year.

Our initial presumption was that the recovery of healthcare spending in the U.S. would be slow, with a more "Nike-swoosh" and less "V-shaped" recovery, as financial constraints would limit capital spending on new ultrasound systems despite pent up demand.

However, the market has recovered strongly in the first half of 2021 on the back of a sharp rebound in imaging volumes, and the increased business confidence means the capital is there for purchasing, particularly for premium systems, as many providers have a preference for their high image quality and advanced features.

As a result, the ultrasound market recovery is expected to be V-shaped, with double-digit growth forecast for 2021, meaning a full recovery of market revenues to 2019 levels. The premium market is forecast to be the fastest growing, driven by strong demand in the established application areas of radiology, cardiology, and women's health.

The Signify View

Despite the impact of the COVID-19 pandemic, the ultrasound market is in a good place in 2021; a full market recovery is forecast to 2019 revenues, with the traditional markets of radiology, cardiology, and women's health driving growth. In the coming years, the market will be expanded by the increasing use of ultrasound in point of care and primary care.

Related Market Report

"World Market for Ultrasound Equipment -- 2021 Edition" provides a data-centric analysis of current and projected demand for cart, compact and handheld ultrasound systems. It features analysis of 30 geographic markets, with breakdowns by clinical application and product mix. The report is based on a robust primary research method and sales data reported by vendors of ultrasound equipment.

Mustafa Hassan is an analyst at Signify Research, a health tech, market-intelligence firm based in Cranfield, U.K.

The comments and observations expressed do not necessarily reflect the opinions of Auntminnie.com or AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.