As many of us gear up for the annual pilgrimage to the RSNA meeting in Chicago, it's safe to expect artificial intelligence and big data will be front and center of the exhibition. Perhaps less expected will be the abundance of visualization software on display from a growing selection of exhibitors.

Once the staple diet of diagnostic and advanced visualization (AV) specialists, viewing software is of great importance to both clinicians and vendors alike. Today, many radiologists use integrated case-load worklists and diagnostic tools in their primary viewer, and the lucky ones have a suite of AV tools too. For most, the biggest change in recent years has been integrating AV tools into a single viewing platform, saving some walking between workstations. No big surprises here. So why the sudden expansion of viewing software?

For that we need to look outside the reading room. Digitalization of healthcare is driving more focus on interoperability and connectivity between clinical disciplines, facilitated by electronic patient record (EPR) and hospital information systems (HIS). Economic uncertainty has also forced more efficiency and cost-saving initiatives. Combined, this has spread digitalization across clinical disciplines and driven providers to adopt an enterprise approach to clinical content.

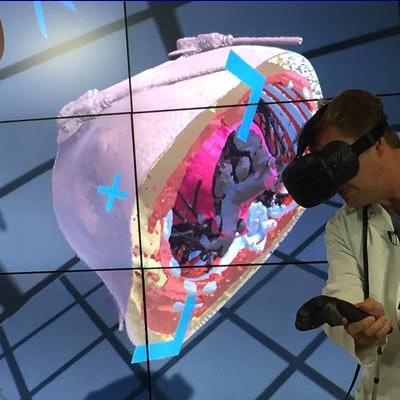

Advanced visualization looks set to feature prominently in the technical exhibition at the RSNA meeting. Image courtesy of Dr. Matthew Bramlet.

Advanced visualization looks set to feature prominently in the technical exhibition at the RSNA meeting. Image courtesy of Dr. Matthew Bramlet.The key questions today are: How will diagnostic viewing find its place in enterprise health IT? Will radiologists lose out in the name of interoperability and enterprise initiatives? Or will radiology remain an island? Can all aspects of clinical viewing be catered for with one solution?

What's in a name?

Firstly, let's dissect visualization into a few clear categories. Essentially there are four types:

- Standalone AV viewers

- Pure-play diagnostic viewers

- Enterprise clinical viewers with diagnostic capability

- Enterprise clinical viewers

In the last three years, distinction between these categories has become challenging. Integration of AV into pure-play diagnostic viewers has been obvious, with far fewer standalone AV workstations in operation today.

Less clear is the role of enterprise or "universal" clinical viewers. This class has grown as a "one-size-fits-all" approach to viewing clinical content across multiple clinical departments, spurred by investment in enterprise IT systems. Many of these viewer products come from vendors with specialism in clinical information management, rather than advanced diagnosis. Deployments are often tied to clinical archive platforms to allow "image-enablement" of the central EPR, which are traditionally poor at handling imaging content. They also tend to benefit nonradiologist users, allowing access to images and reports for clinical review, without the complex nuances and features required for diagnosis and primary reading.

However, the confusion intensifies when the term "enterprise" or "universal" is combined with "diagnostic," as increasingly is the case.

Buzzword bingo

Stephen Holloway is principal analyst and company director at Signify Research.

Stephen Holloway is principal analyst and company director at Signify Research.Pure-play diagnostic viewers are often described as "enterprise" or "universal" to showcase their capability for deployment across multiple imaging departments. This allows collaboration between primary diagnostic sites and imaging departments within a health provider network. However, rarely do these viewers have the underlying content management infrastructure or technical capability to view all types of clinical data, especially for unstructured or non-DICOM content.

At the same time, enterprise clinical viewers are increasingly adding features for diagnostic uses, including worklist tools and common diagnostic functionality. They will allow the radiologist to access a wider variety of non-DICOM content than pure-play diagnostic viewers allow, but don't stand up to the diverse and rigorous diagnostic needs of a large academic medical institution.

A smaller group also offers a wide range of diagnostic tools and high-end 3D rendering functionality alongside full enterprise clinical review capability, rivalling the capabilities of pure-play diagnostic viewing and standalone AV vendors. These solutions are essentially bidding to become the single-use viewer for diagnostic and clinical review purposes, offering both diagnostic and clinical review.

One viewer to rule them all?

In the short- to midterm, the "one-size-fits-all" approach will not win out for every implementation and user type. There are frankly too many disparate legacy applications, stakeholders, and requirements in most provider networks to standardize on a single viewer. A single diagnostic and clinical viewer fits well with the deconstructed PACS model for large providers with advanced needs (see September column), but is normally less appropriate for small- to midsize health providers that don't need advanced AV capability.

However, it's clear that technology is enabling a more universal approach to visualization of clinical content. Thus, we can make a few conclusions for the future of visualization including the following:

- Visualization will be increasingly mobile and collaborative.

- User interfaces will morph.

- Access to advanced diagnostic tools will increasingly be on demand.

Use of "zero-footprint, thin-client" viewers is already common today, enabling access from any location via web access. Despite the challenges of security and compliance, use on mobile devices is also continuing to gain momentum. Add to this the push for collaboration between referring clinicians and diagnostic radiologist, and interoperability of visualization will become increasingly important. It will also over time redefine the clinical role of the radiologist. That said, the rate of this change will be heavily tied to the capability of the infrastructure supporting the viewer, something that remains a hurdle for many healthcare providers with multiple legacy systems and applications.

One of the biggest challenges facing new vendor entrants to radiology is user preference and requirement. Each radiologist and department can have unique demands, such as a specific hanging protocol. With pressure for efficiency and speed of diagnoses increasing, few users want to retrain or change their working practices, often limiting the adoption of new viewers. However, a new generation of viewer technology is allowing configuration of the user interface (UI) to replicate the incumbent system -- essentially the same as reconfiguring an Apple Mac laptop operating system to replicate a Microsoft Windows operating system interface. Each user will be able to uniquely specify their UI and preferences. This will increasingly allow new viewers to be adopted, rather than reliance on renewal with the incumbent.

In the longer term, a single viewer interface is to be expected. When this happens, advanced diagnostic tools will essentially become plug-in applications within the common viewer (think of an app store for AV tools). Increasingly AV and diagnostic tools will also shift toward a pay-per-use model, allowing unique refinement of need while saving money for providers that purchase AV bundles but only use a small proportion of capabilities.

Stephen Holloway is principal analyst and company director at Signify Research (www.signifyresearch.net), a health tech, market-intelligence firm based in Cranfield, U.K.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.