The worst of the pain in the CT sector appears to be over, and the modality has emerged smarter, leaner, and more efficient, but this in no way signals another golden era of booming sales. The next five years will see more consolidation and stringent management of advanced imaging resources.

On the positive side, past reimbursement changes have forced replacement cycles to extend, with the average lifetime for CT systems now at eight to nine years. As a result, those devices purchased during the boom of 2006-2008 will look to be replaced in 2014-2016, driving an uptick in market demand.

But the long-term future of the CT market is far from assured. Growth in installed base and system replacement will no longer be won on high-tech, advanced features alone. Instead, users will demand far greater insight into lifetime cost of ownership, user workflow, and patient-focused advancements. Vendors should also expect healthcare providers to consider lower specification systems within their product range.

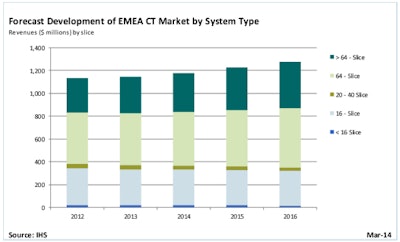

Forecast development of the Europe, Middle East, and Africa (EMEA) CT market by system type.

Forecast development of the Europe, Middle East, and Africa (EMEA) CT market by system type.

Premium CT systems may once again be limited to only top-end research facilities and teaching hospitals; the workhorse CT scanner will take center stage. Dedicated CT also will become common in some applications where cost and efficiency are necessary, most notably in emergency medicine and cardiology. In addition, support for other techniques is growing; e.g., use of cone-beam CT for ear, nose, and throat and extremity imaging, not to mention the ever-increasing clinical scope of ultrasound.

Vendors that can offer an adaptable and cost-effective solution to CT departments in these economically difficult times will reap the rewards of increased installed base and future revenues from services and upgrades. While the past five years of the CT market may have seemed bleak and the next five years are likely to be challenging, the long-term future of CT now appears to be far more secure.

A new era of CT: Dose, patient, cost

In the period from 2005 to 2008, CT manufacturers launched numerous systems in quick succession to win installed base. Slice count was the all important factor, with slice doubling, either in reality or through "virtual" slices, the key selling point for most vendors.

Technology developments since then have remained slow, with the market further struggling to make headway following cuts to reimbursement and precertification requirements from insurance companies. Add in dose concerns and the global economic meltdown and the CT market faced a challenging future.

The economic downturn forced significant market decline from 2008 to 2011. Increased awareness of radiation exposure resulted in more stringent use of CT imaging. Uptake of CT systems was minimal in the developed North American and Western European markets.

The passage of healthcare reform in the U.S. in March 2010 also highlighted overspending in the medical imaging sector, providing a clear target for legislators to reduce expenditure on imaging services. Only new market growth in emerging regions provided any reason for CT vendors to be cheerful.

The last two years have been more positive, with recovery evident in mature markets and vendor confidence growing. As the clouds of gloom slowly lift, a new CT market is also emerging. No longer is high technology the order of the day, and three key themes are evident: dose reduction, patient specificity, and cost saving.

Dose concerns surrounding CT overuse and the lack of dose tracking were both justifiable and severely needed. Dose reduction is achievable in a multitude of ways, as is demonstrated by the new innovations being released in new systems. Dose tracking and data integration with electronic patient records are just the start and should now become commonplace; changing the way CT is used and optimized to patient is a more novel approach.

The use of prescan data and automatic scan protocols designed for optimal scanning and dose that are unique to each patient (as seen on some recently released models) should become more widely available and used. While many technicians and radiologists might bemoan the lack of flexibility with this approach, over time use of preset scans and the dose benefits associated will lead to more efficient, safer scanning. Furthermore, vendors are also utilizing the advances in computational processing to benefit dose. Here, modeling and reconstruction can limit the dose applied in each scan while maintaining the detail and quality of the image generated.

Speed, efficiency, and workflow also are among healthcare providers' top priorities in the ongoing battle to cut CT imaging costs. Improved user workflow and integration with healthcare IT systems in new CT systems offer more streamlined workflows, while "efficient" modes of operation from some vendors now allow system operation in a more power-efficient mode. Vendors are also focused on speeding up the actual scan time itself, either through faster detection or reconstruction.

Nicola Goatman is an analyst with medical devices and healthcare IT at IHS.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.