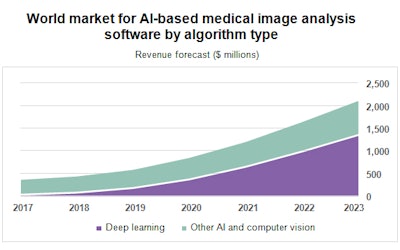

The world market for artificial intelligence (AI) and machine learning in medical imaging, comprising software for automated detection, quantification, decision support, and diagnosis, is set for a period of robust growth and is forecast to top $2 billion by 2023.

Despite some of the earlier market hype, it is becoming increasingly clear that AI will transform the diagnostic imaging industry, both in terms of enhanced productivity, increased diagnostic accuracy, more personalized treatment planning, and ultimately, improved clinical outcomes. AI will play a key role in enabling radiology departments to cope with the ever-increasing volume of diagnostic imaging procedures, despite the chronic shortage of radiologists in many countries.

Following the introduction of deep-learning technology and affordable cloud computing (graphics processing units) and storage, the pace of product development for AI-based medical image analysis tools is faster than ever before. This is leading to increased product availability from a wider selection of vendors and also AI-based tools that are gradually becoming more accurate and sophisticated with added functionalities.

Source: Signify Research.

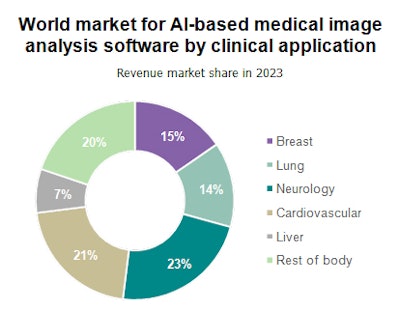

Source: Signify Research.The interest and enthusiasm for AI in the radiologist community have notably increased over the last 12 to 18 months, and the discussion has moved on from AI as a threat to how AI will augment radiologists. At the same time, emerging clinical applications have shown where the use of AI can both improve clinical outcomes and deliver a return on investment for healthcare providers. Examples include software to detect and diagnose stroke and analysis tools to measure blood flow in noninvasive coronary exams.

Source: Signify Research.

Source: Signify Research.While the market holds great promise, it is still in the innovator and early-adopter phase, and several barriers to growth need to be overcome before AI becomes mainstream in medical imaging:

- The regulatory process remains challenging, and there are few approved and fully commercialized products on the market, particularly products based on deep learning

- More large-scale validation studies are needed to show the performance of deep-learning algorithms in real-world clinical settings and boost radiologist confidence in AI.

- The results from AI-based image analysis tools need to be fully integrated into radiologists' workflows and presented at the time of the primary read. Algorithm developers need to partner with imaging IT vendors to ensure their solutions are tightly integrated.

- Healthcare providers are reluctant to purchase AI tools from multiple software developers due to the vendor-specific integration and implementation challenges, as well as the administrative overhead. Algorithm developers need to establish effective routes to market, such as distribution deals with the established medical imaging vendors and the new breed of vendor-neutral AI platforms.

Up to now, the market has mainly been driven by the many start-ups and specialist software developers who are applying machine learning to medical imaging, but the major medical imaging vendors are now ramping up their AI activities. In the last year or so, several of the world's technology giants have applied their AI expertise to medical imaging, most notably China's Tencent and Alibaba. Over the coming years, the combined R&D firepower of the expanding ecosystem will knock down the remaining barriers, and radiologists will have a rapidly expanding array of AI-powered workflow and diagnostic tools at their disposal.

Related market report

Simon Harris.

Simon Harris."Machine Learning in Medical Imaging -- 2018 Edition" provides a data-centric and global outlook on the current and projected uptake of machine learning in medical imaging. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market. More information can be found on Signify Research's website.

Simon Harris is managing director and principal analyst at Signify Research, a health technology market intelligence firm based in Cranfield, U.K. He can be reached at [email protected].

The comments and observations expressed do not necessarily reflect the opinions of AuntMinnie.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.